I was reading the fjollon's blog about VSA and I remembered the challenges I had with the system. While I don't follow VSA, strictly speaking, you can't find a better description of how the markets work anywhere else, even though it's not always like that. Reading the theory is a must regardless of what system a trader uses.

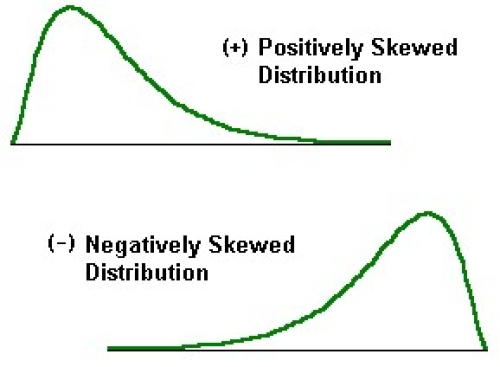

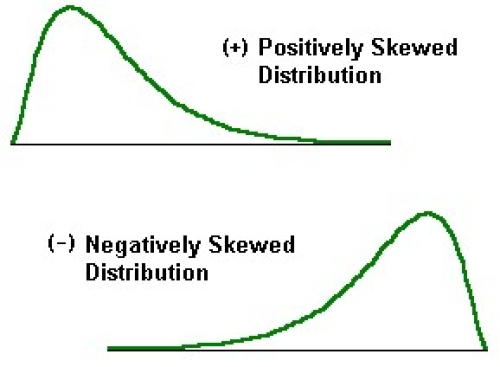

So here is the problem. VSA counts the volume from a bar in any timeframe. Let's say that a daily bar had 1 million lots traded and the bar is 100 pips wide. The volume and trades occurred are distributed over entire bar usually in a bell shape curve with different variations of the bell shape. Sometimes there are two bell curves, sometimes the middle of the curve is on top, sometimes on the bottom. It's common sense that 1 million volume traded at the top and a sharp drop is different then a sharp drop and afterwards 1 million volume traded at the bottom. What if there is a half million on top and half million on the bottom of the bar? Classical VSA ignores these issues but they are addressed and solved using market profile in addition to VSA.

I post a drawing of a bell curve with the volume on top and bottom to make it easier to understand. (it's horizontal instead vertical)

So here is the problem. VSA counts the volume from a bar in any timeframe. Let's say that a daily bar had 1 million lots traded and the bar is 100 pips wide. The volume and trades occurred are distributed over entire bar usually in a bell shape curve with different variations of the bell shape. Sometimes there are two bell curves, sometimes the middle of the curve is on top, sometimes on the bottom. It's common sense that 1 million volume traded at the top and a sharp drop is different then a sharp drop and afterwards 1 million volume traded at the bottom. What if there is a half million on top and half million on the bottom of the bar? Classical VSA ignores these issues but they are addressed and solved using market profile in addition to VSA.

I post a drawing of a bell curve with the volume on top and bottom to make it easier to understand. (it's horizontal instead vertical)