Note: This section contains information in English only.

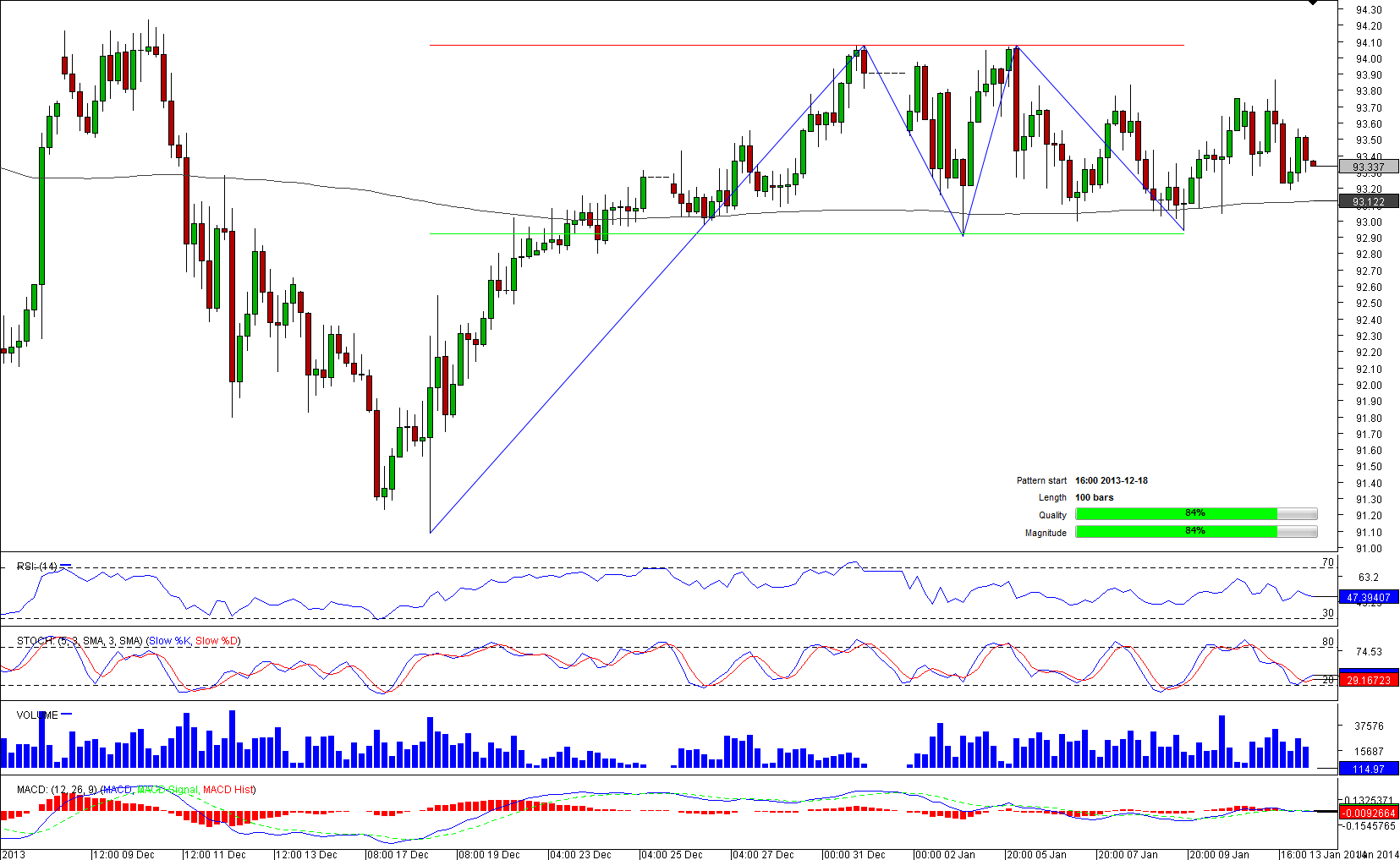

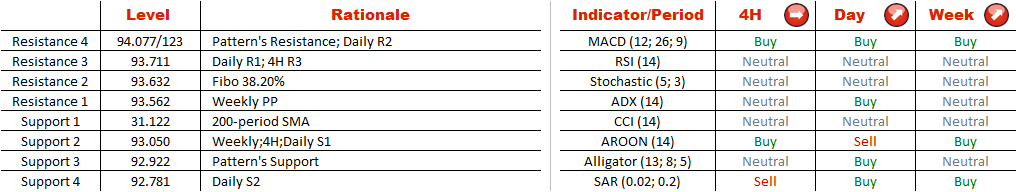

After crossing 92.923 on December 23, AUD/JPY entered a period of consolidation and since than has been moving sideways. There have been four touching points, however, neither of sides was able to push the pair above or below the trend line. As soon as the breakout occurs the pair can be highly profitable for traders, as both quality and magnitude are above the average values. While short-term technical indicators are suggesting a dip towards 200-period SMA, market sentiment (57% bullish), pending orders (58% to buy in a 100-pip range) as well as technical indicators on a daily and weekly charts are pointing at a move to the north, putting pattern's upper boundary on the map.

After crossing 92.923 on December 23, AUD/JPY entered a period of consolidation and since than has been moving sideways. There have been four touching points, however, neither of sides was able to push the pair above or below the trend line. As soon as the breakout occurs the pair can be highly profitable for traders, as both quality and magnitude are above the average values. While short-term technical indicators are suggesting a dip towards 200-period SMA, market sentiment (57% bullish), pending orders (58% to buy in a 100-pip range) as well as technical indicators on a daily and weekly charts are pointing at a move to the north, putting pattern's upper boundary on the map.

Tue, 14 Jan 2014 11:51:33 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request)

la preghiamo di contattarci o richiedere di essere contattato (callback request)

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request).

la preghiamo di contattarci o richiedere di essere contattato (callback request).

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.