© Dukascopy

"The dollar and the yen have their own liabilities, but their relative reliability to the euro zone remains unquestioned"

- UBS (based on Bloomberg)

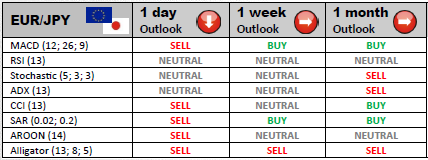

Industry outlook

From above EUR/JPY is capped by resistances at 106.80 and 108.50 which will halt any rallies. The outlook for the pair is negative as it has already pierced through a support at 104.75, and is now on the way to 103.08, then 100.77.

Traders' sentiment

EUR/JPY traders' sentiment is currently mixed, as supporters of neither position have a considerable advantage over the other. 51.73% of traders expect the euro to surge, while 48.27% reckon otherwise.

Long position opened

Largest brokers have set a new long position target as a break of 106.23 will become an encouraging bullish sign en route to 107.44. If the uptrend remains, the third target for intraday trading will be 109.38.

Short position opened

In case of dips, another rally may start after the price rebounds from the initial support level at 104.29. However, assuming that the bearish momentum does not weaken, investors will pay attention to the lower support levels at 103.55 and 101.60.

© Dukascopy