- Bank of Tokyo-Mitsubishi UFJ (based on Bloomberg)

Note: This section contains information in English only.

"The news about Ukraine dominates markets."

"The news about Ukraine dominates markets."

- Bank of Tokyo-Mitsubishi UFJ (based on Bloomberg)

Fri, 18 Jul 2014 06:25:55 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- Bank of Tokyo-Mitsubishi UFJ (based on Bloomberg)

The Euro is getting closer and closer to the key support level at 1.35, which has a chance of stopping the current sell-off and initiating a recovery. However, there will still be tough resistances lying overhead, such as the 200-day SMA at 1.37 and major down-trend at 1.3850. These obstacles are unlikely to let the common currency appreciate in the long run. And if 1.35 fails to underpin the price, it could potentially expose 2013 lows, namely 1.28.

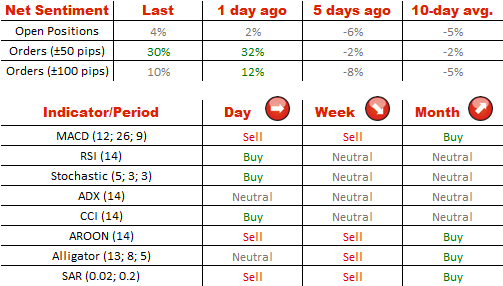

Today there are relatively more long positions than yesterday (52% against 51%), but overall the sentiment remains neutral towards EUR/USD. Meanwhile, 50 pips from the spot the buy orders dominate with 65% of the market.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request)

la preghiamo di contattarci o richiedere di essere contattato (callback request)

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Per scoprire di più sulla piattaforma di Dukascopy Bank per Forex/CFD, sul SWFX ed altre informazioni relative al trading,

la preghiamo di contattarci o richiedere di essere contattato (callback request).

la preghiamo di contattarci o richiedere di essere contattato (callback request).

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.