Although it seems like most of the market is long USDCAD at this point against the longer term trendline, I've closed my long some time ago and been holding the short side.

It seems most of my trades are against the consensus these days, as I continue to look for USD weakness despite today's EURUSD breakdown (I'm still holding long btw).

I can't ignore the signals I am getting from Gold, USDNOK, EURCAD, & GBPCAD - which all point to USD weakness and CAD strength. As well, in my previous post I mentioned USDCHF has not broken to new highs (still short that too).

I rather trade something I see then not trade it, despite what everyone else is doing.

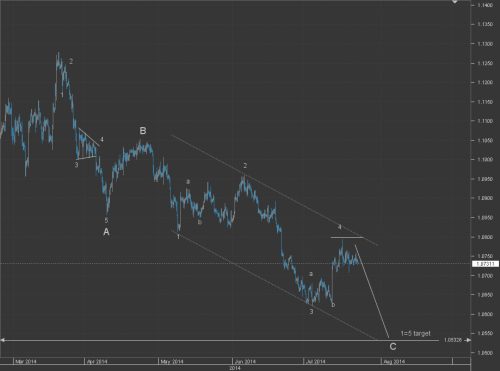

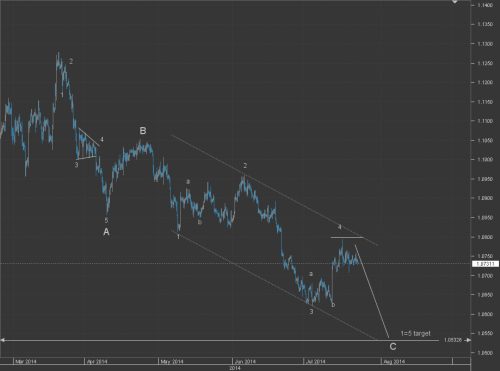

The above chart shows the wave count from the highs. I tend to label more charts corrective, but it's hard to deny an impulsive count here. So far the move to the downside from 4 does not look impulsive. The 4 does look in place however, the channel gives a good indication, as well there shouldn't be overlap with 1. Above 1.0812 invalidates this count.

It seems most of my trades are against the consensus these days, as I continue to look for USD weakness despite today's EURUSD breakdown (I'm still holding long btw).

I can't ignore the signals I am getting from Gold, USDNOK, EURCAD, & GBPCAD - which all point to USD weakness and CAD strength. As well, in my previous post I mentioned USDCHF has not broken to new highs (still short that too).

I rather trade something I see then not trade it, despite what everyone else is doing.

The above chart shows the wave count from the highs. I tend to label more charts corrective, but it's hard to deny an impulsive count here. So far the move to the downside from 4 does not look impulsive. The 4 does look in place however, the channel gives a good indication, as well there shouldn't be overlap with 1. Above 1.0812 invalidates this count.