Hi All,

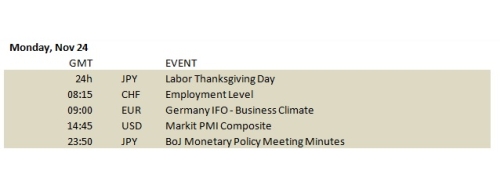

As promised in my last blog, I present fundamental analysis for Monday's key economic events.

>>Labor Thanksgiving Day is a national holiday in Japan which takes place annually on November 23. The law establishing the holiday cites it as an occasion for commemorating labor and production and giving one another thanks.So,JPY pairs will move in a small range due to closure of Japanese markets.

>>Labor Thanksgiving Day is a national holiday in Japan which takes place annually on November 23. The law establishing the holiday cites it as an occasion for commemorating labor and production and giving one another thanks.So,JPY pairs will move in a small range due to closure of Japanese markets.

>>Swiss Employment Level is to be released at 08:15 GMT with FORECAST at 4.22M and PREVIOUS at 4.20M. Job creation is an important indicator of consumer spending.A higher than expected reading should be taken as positive/bullish for the CHF,while a lower than expected reading should be taken as negative/bearish for the CHF.

From above data,it can be inferred that recent final readings have been above the 4.15M level and this time too they will meet the expectation and CHF pairs can have bullish impact.

>>German Ifo Business Climate Index (Nov) is to be released at 09:00 GMT with FORECAST at 103.0 and PREVIOUS at 103.20.

Ifo institute’s business climate index, based on a survey of 7,000 executives, dropped to 103.2 in October from 104.7 in September. That’s the lowest since December 2012..Since final readings have never met the expectations, I see downtrend to continue and EUR pairs to deteriorate further.

Germany’s export-oriented economy is suffering from sanctions against Russia and instability in the Middle East. A slowing economy in China, the country’s third-largest trading partner and weaker demand from its euro-region peers are adding to risks.

>>US Services PMI is scheduled at 14:45 GMT with FORECAST at 57.3 and PREVIOUS at 57.1.

US service sector activity remains solid but slowed to a six-month low in October.Last month's flash reading on US services PMI from Markit came in at 57.3 against forecast of 57.9.It was further downward revised to 57.1 for final readings.

US service sector activity remains solid but slowed to a six-month low in October.Last month's flash reading on US services PMI from Markit came in at 57.3 against forecast of 57.9.It was further downward revised to 57.1 for final readings.

Services PMI level above 50 signals an improvement, and below 50 indicates a deterioration. A reading that is stronger than forecast is generally supportive (bullish) for the USD, while a weaker than forecast reading is generally negative (bearish) for the USD.Data shows that in recent months actual readings have never met the forecast but have been steady over 56. If data comes out in line with forecast of 57.3 - I foresee bullish impact for USD.

That's all folks for now !!

By the way, my team Man Utd did win against Arsenal 2-1 courtesy ROONEYYYYYY !!!!

Green pips everyone,

bharatholsa

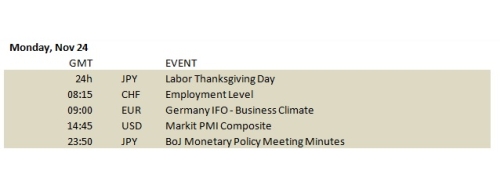

As promised in my last blog, I present fundamental analysis for Monday's key economic events.

>>Labor Thanksgiving Day is a national holiday in Japan which takes place annually on November 23. The law establishing the holiday cites it as an occasion for commemorating labor and production and giving one another thanks.So,JPY pairs will move in a small range due to closure of Japanese markets.

>>Labor Thanksgiving Day is a national holiday in Japan which takes place annually on November 23. The law establishing the holiday cites it as an occasion for commemorating labor and production and giving one another thanks.So,JPY pairs will move in a small range due to closure of Japanese markets.>>Swiss Employment Level is to be released at 08:15 GMT with FORECAST at 4.22M and PREVIOUS at 4.20M. Job creation is an important indicator of consumer spending.A higher than expected reading should be taken as positive/bullish for the CHF,while a lower than expected reading should be taken as negative/bearish for the CHF.

From above data,it can be inferred that recent final readings have been above the 4.15M level and this time too they will meet the expectation and CHF pairs can have bullish impact.

>>German Ifo Business Climate Index (Nov) is to be released at 09:00 GMT with FORECAST at 103.0 and PREVIOUS at 103.20.

Ifo institute’s business climate index, based on a survey of 7,000 executives, dropped to 103.2 in October from 104.7 in September. That’s the lowest since December 2012..Since final readings have never met the expectations, I see downtrend to continue and EUR pairs to deteriorate further.

Germany’s export-oriented economy is suffering from sanctions against Russia and instability in the Middle East. A slowing economy in China, the country’s third-largest trading partner and weaker demand from its euro-region peers are adding to risks.

>>US Services PMI is scheduled at 14:45 GMT with FORECAST at 57.3 and PREVIOUS at 57.1.

US service sector activity remains solid but slowed to a six-month low in October.Last month's flash reading on US services PMI from Markit came in at 57.3 against forecast of 57.9.It was further downward revised to 57.1 for final readings.

US service sector activity remains solid but slowed to a six-month low in October.Last month's flash reading on US services PMI from Markit came in at 57.3 against forecast of 57.9.It was further downward revised to 57.1 for final readings.Services PMI level above 50 signals an improvement, and below 50 indicates a deterioration. A reading that is stronger than forecast is generally supportive (bullish) for the USD, while a weaker than forecast reading is generally negative (bearish) for the USD.Data shows that in recent months actual readings have never met the forecast but have been steady over 56. If data comes out in line with forecast of 57.3 - I foresee bullish impact for USD.

That's all folks for now !!

By the way, my team Man Utd did win against Arsenal 2-1 courtesy ROONEYYYYYY !!!!

Green pips everyone,

bharatholsa