从7种资产类别中进行选择,并可以使用1200多种交易工具

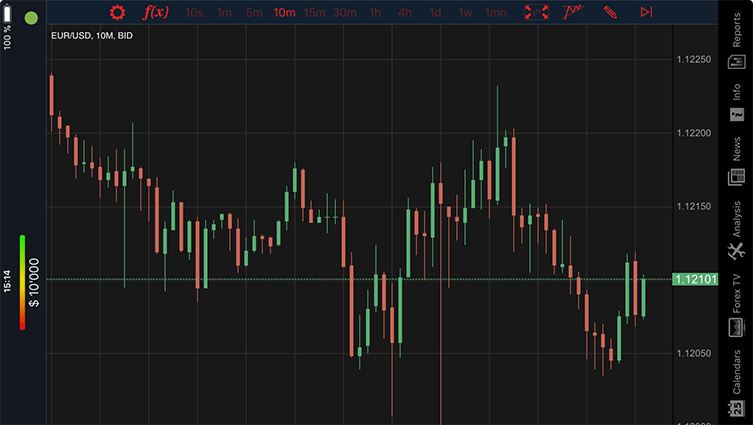

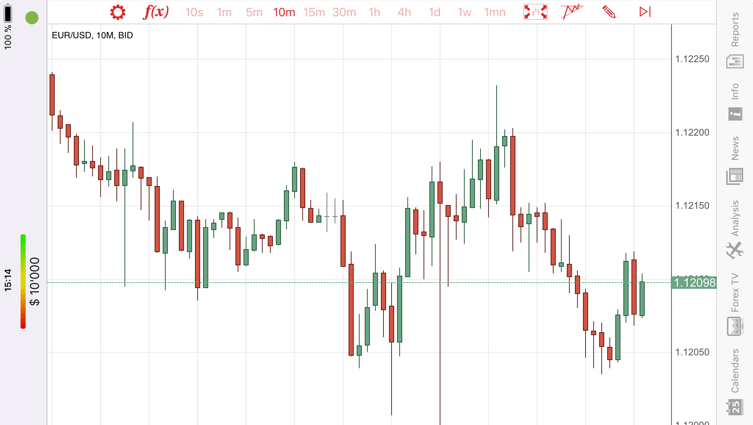

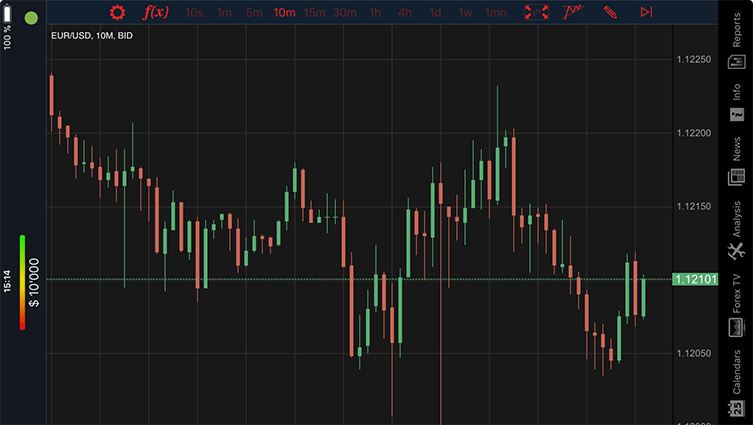

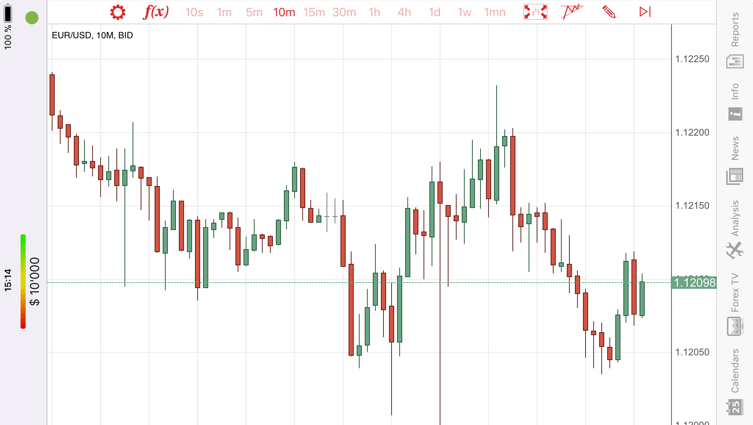

查看最佳买入价/卖出价价格走势的历史。使用完全可自定义的设置构建任何图表—包括砖形图,Kagi或断线图。这对于自动化策略测试而言变得更加重要。

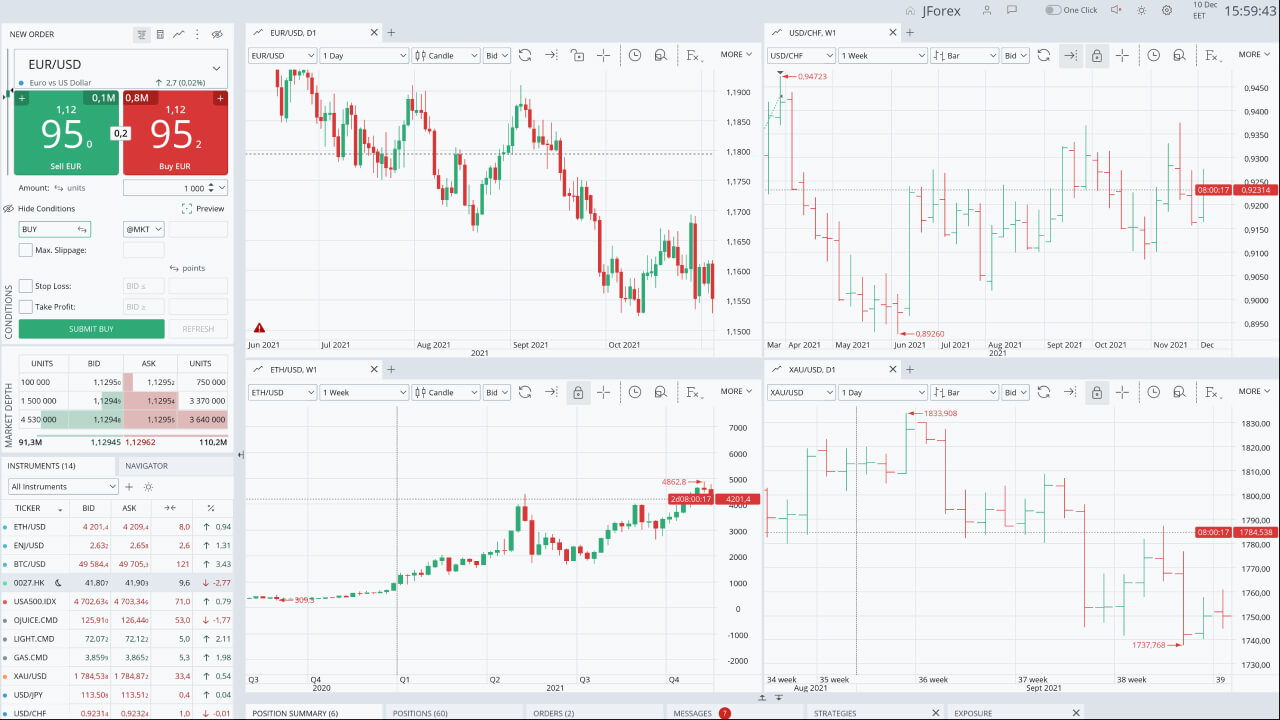

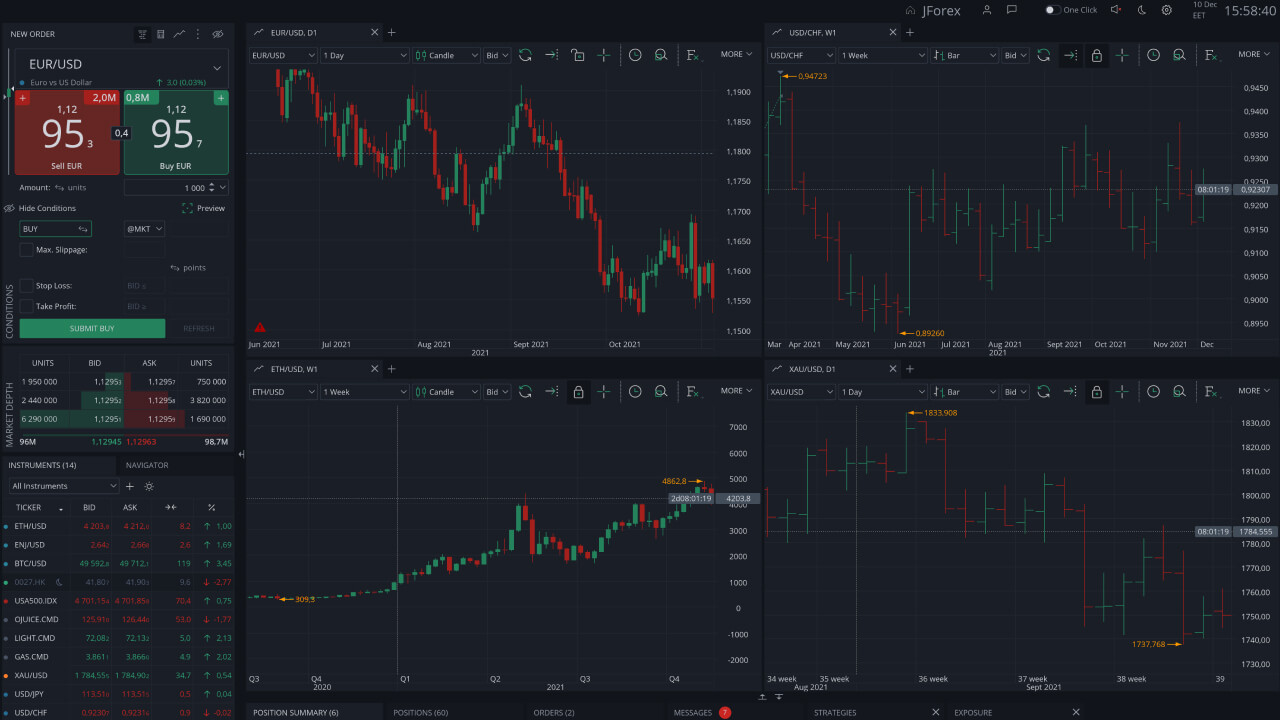

启用最大滑点选项,以设置市场上可能的最糟的价格或止损订单。将其设置为零可完全消除较差的执行。

这种粒度有助于交易者确定不同价格的买卖订单的数量。它显示最多订单集中的地方。

通过同步布局和图表模板的任何计算机上打开交易平台。

在图表上直接查看经济事件的数据及其影响。

通过资产,工具或头寸监控您的暴露。

通过监视距离直到您的止盈和止损水平,开盘价和当前市场价来应对市场变化—全部集中在一处。

大量的指标和图表工具可供选择,使您的交易更上一层楼。

添加您最喜欢的外汇和差价合约工具,并遵循每日的最高价和最低价。

| 功能 | JFOREX | Apple iOS | Web | Android |

|---|---|---|---|---|

| 防滑点功能 | ||||

| 买/卖挂单(4) | ||||

| 支持对冲 | (1) | |||

| 净头寸“模式(4) | ||||

| 技术分析工具 | (2) | (2) | (2) | |

| 新闻和分析功能 | ||||

| 市场警报 | ||||

| 交流工具 | ||||

| 自动交易 (策略研发) | (3) | |||

| 多种语言界面 | ||||

| 自定义设置 | ||||

| 更新速度设置 | ||||

| 自动尾随止损单 | (1) | |||

| 单击交易模式 |

JForex 4 offers traders the opportunity to trade over 1200 instruments across eight asset classes, including forex and CFD. MT4 and MT5 provide access to 108 instruments, including popular currency pairs.

The best trading platform is dependent upon your experience, requirements, and preferences. Dukascopy offers a range of platforms, including MT5 and MT4, as well as the advanced JForex 4, each with distinct advantages for currency trading. MT4 and MT5 allow trading of up to 108 assets, while JForex 4 enables trading of over 1200 instruments. Research and compare features such as charting tools, mobile apps, and automated trading capabilities to find the platform that best suits you.

Online currency trading involves selecting a regulated forex broker, opening a trading account, and depositing funds. Once you have gained familiarity with the basics (pips, leverage, and margin), you can develop a trading strategy (technical or fundamental analysis) and practice with a demo account. When you are ready, you can start with small trades and utilize risk management tools like stop-loss orders to limit potential losses as you navigate the dynamic forex market.

Currency trading can be suitable for beginners, but it requires a solid understanding of the forex market and a disciplined approach. The market's high liquidity and potential for profit attract many new traders; however, the significant risks and volatility mean that thorough education and careful planning are essential. Beginners should start with a demo account to practice trading strategies without financial risk and gradually transition to live trading as they gain experience and confidence.

These are the simple steps to start trading:

If you want to learn currency trading, you need to start by studying the fundamentals. There are plenty of online courses, books, and tutorials out there that will teach you everything you need to know about the forex market, including the basics, technical and fundamental analysis, and trading strategies. Use a demo account offered by Dukascopy Bank to practice what you've learned. Additionally, join online trading communities, follow market news, and consider attending webinars or workshops to stay updated on market trends and deepen your understanding. Review and refine your strategies continuously, based on your experiences and evolving market conditions.

For beginners, major currency pairs, such as EUR/USD, USD/JPY, GBP/USD, might be a good starting point. These pairs tend to be more liquid (meaning easier to buy and sell) and have tighter spreads, which can be helpful when starting out. However, even these major pairs can be volatile, so it is advisable to prioritize education, risk management, and practicing with a demo account before risking real money.