Aggregate indicators on the 1W horizon strongly point at bearish market outbreak. Current market sentiment is around 70% bearish as well. Short traders could focus on the daily support level at 0.7526. If the pair breaches this level, next possible target could be at the second daily support at 0.7503.

Note: This section contains information in English only.

Aggregate indicators on the 1W horizon strongly point at bearish market outbreak. Current market sentiment is around 70% bearish as well. Short traders could focus on the daily support level at 0.7526. If the pair breaches this level, next possible target could be at the second daily support at 0.7503.

Tue, 05 Jun 2012 14:44:17 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

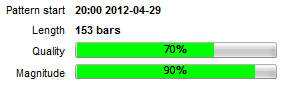

NZD/USD is slowing down after hitting the lowest level this year and has formed a Double Bottom pattern on the 4H chart. The pattern has 70% quality and 90% magnitude in the 153-bar period.

The pattern started when pair dropped from 0.8234 and after bouncing from 0.7455 for a few times while testing a resistance level at 0.7648 it has slowed down at 0.752 where the pair is currently trading. Aggregate indicators do not suggest clear emerging patterns at 4H and 1D time horizons but the Stochastic and the RSI indicators point at bullish market outbreak in 1W time horizon. Long traders could focus on the daily resistance level at 0.7563. If this level will be breached, next target could be at a second daily resistance at 0.7597.

Aggregate indicators on the 1W horizon strongly point at bearish market outbreak. Current market sentiment is around 70% bearish as well. Short traders could focus on the daily support level at 0.7526. If the pair breaches this level, next possible target could be at the second daily support at 0.7503.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.