Note: This section contains information in English only.

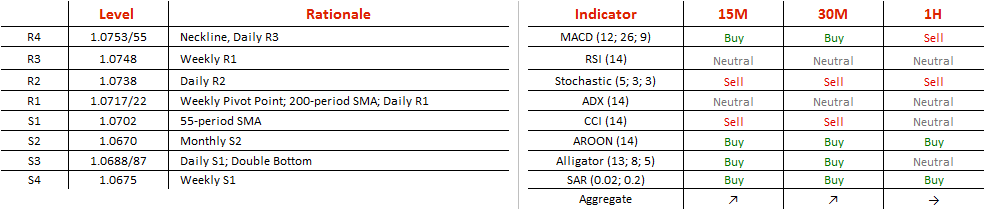

EUR/CHF put an end to the downtrend with a double bottom formation at 1.0687. The pair had not attacked levels as low since the Brexit dip and August 2015 before that, meaning that it is highly likely that the neckline at 1.0753 will break. The rate will face the 1.0717/22 cluster of resistances, 1.0738 and then 1.0748 before the neckline is reached. In the current consolidation, the rate has sketched a small-scale symmetrical triangle, and the initiated up-wave suggests that bullish potential is built up and the surge will be sustainable. The pair might still have some trouble exiting the low-volatility trap it is currently in, caused by 100 and 55-period SMAs squeezing it from both sides.

EUR/CHF put an end to the downtrend with a double bottom formation at 1.0687. The pair had not attacked levels as low since the Brexit dip and August 2015 before that, meaning that it is highly likely that the neckline at 1.0753 will break. The rate will face the 1.0717/22 cluster of resistances, 1.0738 and then 1.0748 before the neckline is reached. In the current consolidation, the rate has sketched a small-scale symmetrical triangle, and the initiated up-wave suggests that bullish potential is built up and the surge will be sustainable. The pair might still have some trouble exiting the low-volatility trap it is currently in, caused by 100 and 55-period SMAs squeezing it from both sides.

Mon, 21 Nov 2016 07:43:12 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.