Note: This section contains information in English only.

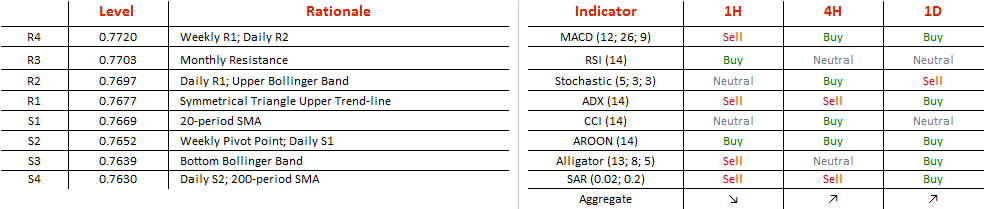

A symmetrical and ascending triangle combination suggests a long-term surge for AUD/USD, setting eyes on 0.7652 as the first level on the current wave down. Most recent movements have, however, arguably taken the form of a channel down or falling wedge and considering the other patterns, we would lean towards a wedge, which confirms the bullish signal of other patterns. We will therefore look for a wave south towards 0.7576 with resistances at 0.7652, 0.7630 and 0.7607/06 – and there is a possibility that the pair could fail to extend the weakness below one of them and not reach the targeted trend-line. A break above the symmetrical triangle upside border at 0.7686 would be capped by 0.7697/98 or 0.7703 where the rate would likely undergo a retracement.

A symmetrical and ascending triangle combination suggests a long-term surge for AUD/USD, setting eyes on 0.7652 as the first level on the current wave down. Most recent movements have, however, arguably taken the form of a channel down or falling wedge and considering the other patterns, we would lean towards a wedge, which confirms the bullish signal of other patterns. We will therefore look for a wave south towards 0.7576 with resistances at 0.7652, 0.7630 and 0.7607/06 – and there is a possibility that the pair could fail to extend the weakness below one of them and not reach the targeted trend-line. A break above the symmetrical triangle upside border at 0.7686 would be capped by 0.7697/98 or 0.7703 where the rate would likely undergo a retracement.

Mon, 07 Nov 2016 07:31:04 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.