Note: This section contains information in English only.

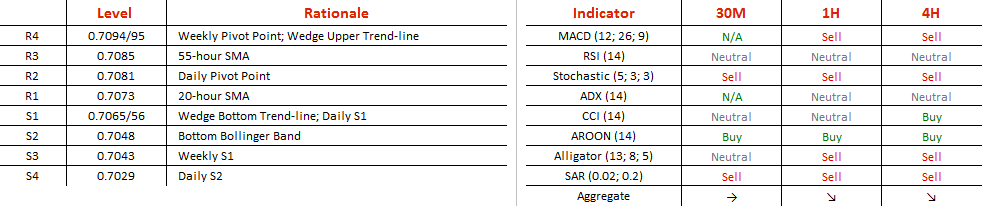

Sticking to the bottom trend-line of the almost two-week wedge, NZD/CHF shows little doubt of a bear-trend, at least as high as 0.7089 – the upper trend-line of the wedge. The rate will have to battle 0.7073 and 0.7081 before the trend-line is attempted, and a close above would shift risk to 0.7098/99 or 0.7107/08 which would then leave little to 0.7114, the 200-hour SMA. In case recent tests of the bottom trend-line drive the trend south, weakness below 0.7059 would open the way to 0.7056 and 0.7048/0.7043. With an overwhelming majority (70%) of bears expecting gains on NZD/CHF, pressures towards equilibrium could cause the wedge to break soon.

Sticking to the bottom trend-line of the almost two-week wedge, NZD/CHF shows little doubt of a bear-trend, at least as high as 0.7089 – the upper trend-line of the wedge. The rate will have to battle 0.7073 and 0.7081 before the trend-line is attempted, and a close above would shift risk to 0.7098/99 or 0.7107/08 which would then leave little to 0.7114, the 200-hour SMA. In case recent tests of the bottom trend-line drive the trend south, weakness below 0.7059 would open the way to 0.7056 and 0.7048/0.7043. With an overwhelming majority (70%) of bears expecting gains on NZD/CHF, pressures towards equilibrium could cause the wedge to break soon.

Mon, 31 Oct 2016 08:30:57 GMT

Source: Dukascpy Bank SA

© Dukascpy Bank SA

© Image watermark

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.