Note: This section contains information in English only.

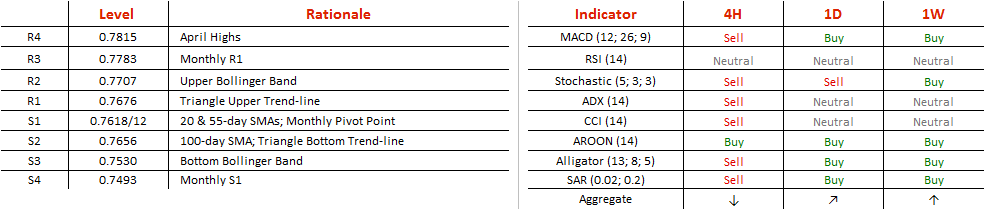

Following a false break above the upper trend-line of the symmetrical triangle AUD/USD entered in January, the pair has returned into the pattern and appears to be launching a new attack at the targeted trend-line. Using the 55-day SMA at 0.7612 to step towards levels above, the rate will test 0.7673 latest mid-November. With demand pressures stemming from below in the form of various time-frame SMAs, we look for the rate to be elevated at least towards 0.7783 until the end of the year with further risk at 0.7815, where the April highs lie. 64% of traders betting on a bearish Australian Dollar just confirm our expectations of an bullish market.

Following a false break above the upper trend-line of the symmetrical triangle AUD/USD entered in January, the pair has returned into the pattern and appears to be launching a new attack at the targeted trend-line. Using the 55-day SMA at 0.7612 to step towards levels above, the rate will test 0.7673 latest mid-November. With demand pressures stemming from below in the form of various time-frame SMAs, we look for the rate to be elevated at least towards 0.7783 until the end of the year with further risk at 0.7815, where the April highs lie. 64% of traders betting on a bearish Australian Dollar just confirm our expectations of an bullish market.

Mon, 24 Oct 2016 07:49:25 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.