Note: This section contains information in English only.

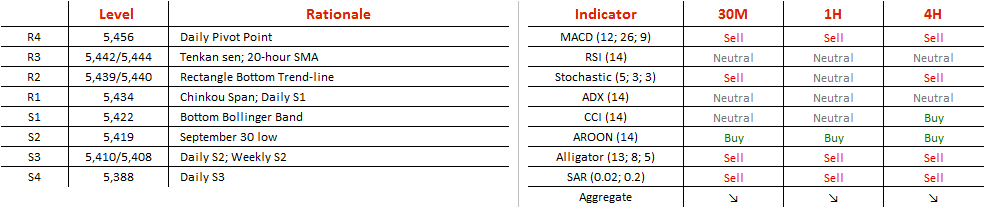

The Australian index concluded its consolidation period with a violation of the 5'439 bottom trend-line of the rectangle it has consistently traded in for the last two weeks. Following a retracement to the broken demand zone, the gauge is on its way to test 5'409/5'407 after battling 5'419, the September 30 low. Adding more ground to our presumption of an extended downtrend, a death cross has been formed above the current index level of 5'429 Australian Dollars. We see the SWFX market betting on the rate to dip with 72% of positions being long, suggesting that the strongly oversold index might require some buying pressures to approach equilibrium. The daily S1 and Chinkou Span confluence at 5'434 would then cap a short-term movement north.

The Australian index concluded its consolidation period with a violation of the 5'439 bottom trend-line of the rectangle it has consistently traded in for the last two weeks. Following a retracement to the broken demand zone, the gauge is on its way to test 5'409/5'407 after battling 5'419, the September 30 low. Adding more ground to our presumption of an extended downtrend, a death cross has been formed above the current index level of 5'429 Australian Dollars. We see the SWFX market betting on the rate to dip with 72% of positions being long, suggesting that the strongly oversold index might require some buying pressures to approach equilibrium. The daily S1 and Chinkou Span confluence at 5'434 would then cap a short-term movement north.

Thu, 13 Oct 2016 07:14:38 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.