Note: This section contains information in English only.

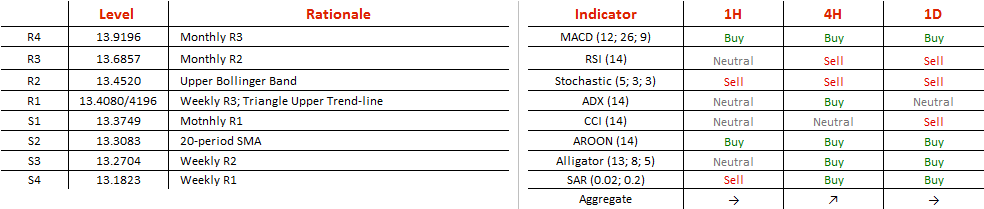

To consolidate the downward motion, HKD/JPY entered a descending channel pattern, building up some bearish potential for a break below the support level at 12.9269. The break, however, did not go as planned, establishing a new high at 13.4194, which has sketched another upper trend-line of the triangle. We believe that the break will come either on the current wave or following several additional confirmations of the newly formed trend-line. With several SMAs pushing from below, the pair will have to put up a fight to battle through levels of significance, especially the SMA-Pivot Point-Bollinger Band confluence at 13.1090/1645. When a successful violation of the bottom line is accomplished, HKD/JPY will test 12.8302/8190 and most likely rebound for a more sufficient dip. Another scenario consists of a rebound from the recently broken trend-line at 13.0717 and an extension of the rally towards July highs at 13.8421.

To consolidate the downward motion, HKD/JPY entered a descending channel pattern, building up some bearish potential for a break below the support level at 12.9269. The break, however, did not go as planned, establishing a new high at 13.4194, which has sketched another upper trend-line of the triangle. We believe that the break will come either on the current wave or following several additional confirmations of the newly formed trend-line. With several SMAs pushing from below, the pair will have to put up a fight to battle through levels of significance, especially the SMA-Pivot Point-Bollinger Band confluence at 13.1090/1645. When a successful violation of the bottom line is accomplished, HKD/JPY will test 12.8302/8190 and most likely rebound for a more sufficient dip. Another scenario consists of a rebound from the recently broken trend-line at 13.0717 and an extension of the rally towards July highs at 13.8421.

Fri, 07 Oct 2016 07:08:27 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.