Note: This section contains information in English only.

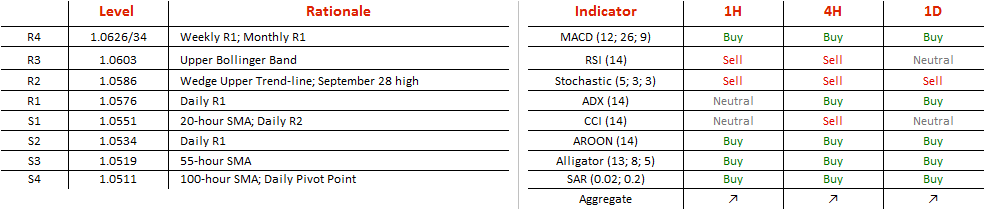

AUD/NZD entered an ascending channel that still lacks confirmation, but implies that the rate should dip to 1.0510 over the next couple of days. A tap at the level would result in an extension of the overall rally, setting 1.0626/34 as the next conquest, which would then open the way to the 1.0723/39 supply area. In case the pair fails to confirm the strength of the channel, the bulls would take over right away, setting sights on the aforementioned resistances immediately. Downside breakouts are held by 1.0494/90 where the Monthly Pivot Point, Bottom Bollinger Band and weekly S1 confluence provides significant demand pressures.

AUD/NZD entered an ascending channel that still lacks confirmation, but implies that the rate should dip to 1.0510 over the next couple of days. A tap at the level would result in an extension of the overall rally, setting 1.0626/34 as the next conquest, which would then open the way to the 1.0723/39 supply area. In case the pair fails to confirm the strength of the channel, the bulls would take over right away, setting sights on the aforementioned resistances immediately. Downside breakouts are held by 1.0494/90 where the Monthly Pivot Point, Bottom Bollinger Band and weekly S1 confluence provides significant demand pressures.

Wed, 28 Sep 2016 14:18:54 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.