Note: This section contains information in English only.

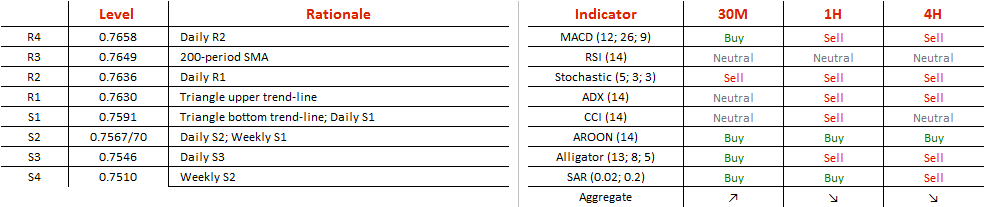

Following the symmetrical triangle pattern, the AUD/USD currency pair can be expected to continue its way south from the 0.7628 level where it has been testing the upper trend-line. If the trend does continue, the currency will overstep the bottom trend-line at 0.7591, followed by a dip towards daily S2 at 0.7567. The crossover of the 55-hour SMA and the 100-hour SMA however gives reason to believe that a trend reversal could take place as well. In case the pair does break through the level at the top trend-line of the triangle, it will fail at the intermediate resistance of 0.7636, bounce back from the trend-line and then rally towards the 200-hour SMA, and if broken – an attempt to cross the daily R2 at 0.7658 will be made. Aggregate hourly and 4 hour technical indicators on the other hand do show potential gains from taking short positions - a forecast supported by the ascending wedge pattern formed in the daily chart since May.

Following the symmetrical triangle pattern, the AUD/USD currency pair can be expected to continue its way south from the 0.7628 level where it has been testing the upper trend-line. If the trend does continue, the currency will overstep the bottom trend-line at 0.7591, followed by a dip towards daily S2 at 0.7567. The crossover of the 55-hour SMA and the 100-hour SMA however gives reason to believe that a trend reversal could take place as well. In case the pair does break through the level at the top trend-line of the triangle, it will fail at the intermediate resistance of 0.7636, bounce back from the trend-line and then rally towards the 200-hour SMA, and if broken – an attempt to cross the daily R2 at 0.7658 will be made. Aggregate hourly and 4 hour technical indicators on the other hand do show potential gains from taking short positions - a forecast supported by the ascending wedge pattern formed in the daily chart since May.

Thu, 25 Aug 2016 06:51:06 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.