Note: This section contains information in English only.

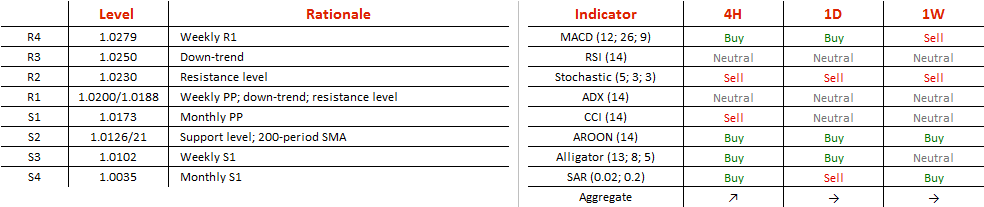

The Australian Dollar is set to decline against its Singapore counterpart. The currency pair confirmed the multi-year falling resistance line in the first half of July, and since then AUD/SGD has formed a pattern that indicates weakening demand. Our near-term target is 1.0125/20, created by the lower bound of the descending triangle and by the 200-period SMA. Despite the toughness of this area, however, it is expected to be breached in the longer-term perspective, and the new objective will then be 0.99. An additional argument in favour of a decline is the fact that the Aussie is heavily overbought—three out of four open positions in the SWFX market are currently long.

The Australian Dollar is set to decline against its Singapore counterpart. The currency pair confirmed the multi-year falling resistance line in the first half of July, and since then AUD/SGD has formed a pattern that indicates weakening demand. Our near-term target is 1.0125/20, created by the lower bound of the descending triangle and by the 200-period SMA. Despite the toughness of this area, however, it is expected to be breached in the longer-term perspective, and the new objective will then be 0.99. An additional argument in favour of a decline is the fact that the Aussie is heavily overbought—three out of four open positions in the SWFX market are currently long.

Mon, 01 Aug 2016 06:32:09 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.