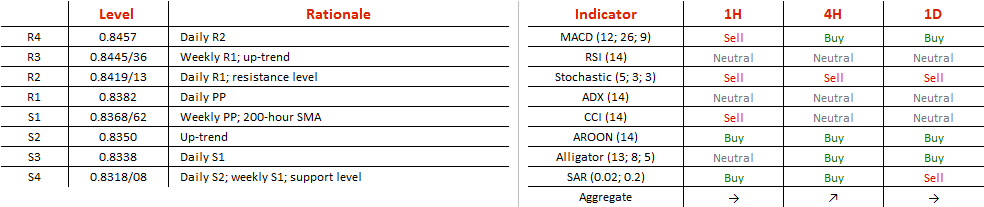

The problem with the bullish outlook is the supposed supply area circa 0.8440, created by the 13-month up-trend. This line was broken in the first half of July, but in mid-July the price fell beneath this resistance once again. This means that the bias will remain negative as long as both these levels are intact. If both obstacles are nevertheless overcome, the rate will likely target 0.86.

Note: This section contains information in English only.

The pattern EUR/GBP is currently forming indicates growing demand for the Euro. The key resistance in this case is thus 0.8420. At the same time, the rally is suggested by the positioning of the SWFX market participants: 38% of positions are long and 62% are short.

The pattern EUR/GBP is currently forming indicates growing demand for the Euro. The key resistance in this case is thus 0.8420. At the same time, the rally is suggested by the positioning of the SWFX market participants: 38% of positions are long and 62% are short.

The problem with the bullish outlook is the supposed supply area circa 0.8440, created by the 13-month up-trend. This line was broken in the first half of July, but in mid-July the price fell beneath this resistance once again. This means that the bias will remain negative as long as both these levels are intact. If both obstacles are nevertheless overcome, the rate will likely target 0.86.

Wed, 27 Jul 2016 06:33:51 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

The problem with the bullish outlook is the supposed supply area circa 0.8440, created by the 13-month up-trend. This line was broken in the first half of July, but in mid-July the price fell beneath this resistance once again. This means that the bias will remain negative as long as both these levels are intact. If both obstacles are nevertheless overcome, the rate will likely target 0.86.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.