Note: This section contains information in English only.

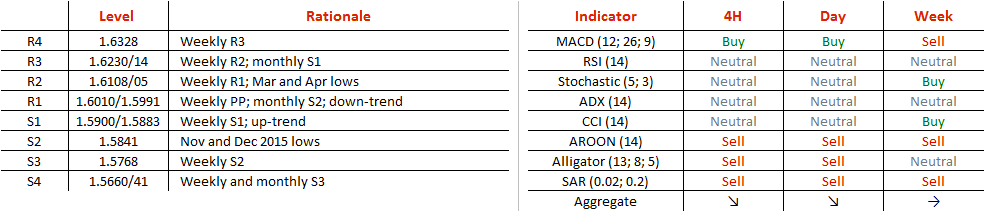

Regardless of the pattern EUR/NZD is currently forming (either symmetrical or descending channel), the risks are considered to be skewed to the downside. Apart from the figure the sell-off is also implied by the technical indicators both in the four-hour and daily charts. In addition, 61% of positions presently open in the SWFX market are long, meaning there is plenty of room for new sellers to execute their trades and drive the price lower. The main obstacle for the decline from here is at 1.5840, represented by the lows seen in November and December of the previous year. If this support is breached, the next target is to be 1.5660/40, namely a combination of the weekly and monthly S3 levels.

Regardless of the pattern EUR/NZD is currently forming (either symmetrical or descending channel), the risks are considered to be skewed to the downside. Apart from the figure the sell-off is also implied by the technical indicators both in the four-hour and daily charts. In addition, 61% of positions presently open in the SWFX market are long, meaning there is plenty of room for new sellers to execute their trades and drive the price lower. The main obstacle for the decline from here is at 1.5840, represented by the lows seen in November and December of the previous year. If this support is breached, the next target is to be 1.5660/40, namely a combination of the weekly and monthly S3 levels.

Tue, 21 Jun 2016 07:04:04 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.