Note: This section contains information in English only.

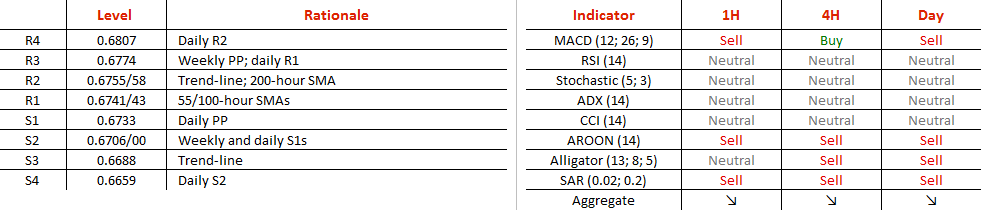

The trading range of the Kiwi/Dollar has been narrowing since May 17 when this currency pair has commenced a first leg down in the direction of 0.67. Now the difference between the upper and lower trend-lines amounts to only 60 pips and it will continue decreasing. Under the base scenario we will see a fresh slump down to 0.67, namely the weekly and daily S1s, followed by the pattern's support at 0.6688. This idea is backed by all technical indicators. Despite that, falling wedges imply an upward breakout in the future and this may happen throughout the next trading week. However, the 200-hour SMA at 0.6758 will likely attempt to limit the rally, but the SWFX market remains positive (55% long).

The trading range of the Kiwi/Dollar has been narrowing since May 17 when this currency pair has commenced a first leg down in the direction of 0.67. Now the difference between the upper and lower trend-lines amounts to only 60 pips and it will continue decreasing. Under the base scenario we will see a fresh slump down to 0.67, namely the weekly and daily S1s, followed by the pattern's support at 0.6688. This idea is backed by all technical indicators. Despite that, falling wedges imply an upward breakout in the future and this may happen throughout the next trading week. However, the 200-hour SMA at 0.6758 will likely attempt to limit the rally, but the SWFX market remains positive (55% long).

Fri, 27 May 2016 13:18:04 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.