Note: This section contains information in English only.

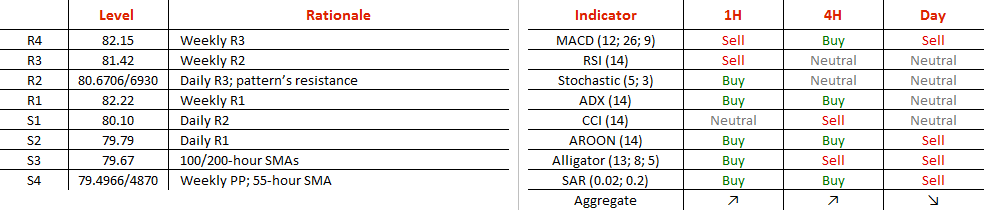

Outlook for the Aussie is bullish, although some downside risks are going to persist in the foreseeable future. AUD/JPY is expected to test the pattern's upper boundary, which is represented by the May 10 high at 80.693. By violating this reading, the pair will set eye on the second weekly resistance that lies at 81.4186, with the current May peak and weekly R3 both following near 82 yen per one Australian Dollar. At the same time, long-term technical studies are not overwhelmingly optimistic, despite the fact that the double bottom pattern implies a reversal of a trend. Moreover, the vast majority (73%) of all SWFX positions are long, meaning here the risks are also skewed in favour of the bearish camp.

Outlook for the Aussie is bullish, although some downside risks are going to persist in the foreseeable future. AUD/JPY is expected to test the pattern's upper boundary, which is represented by the May 10 high at 80.693. By violating this reading, the pair will set eye on the second weekly resistance that lies at 81.4186, with the current May peak and weekly R3 both following near 82 yen per one Australian Dollar. At the same time, long-term technical studies are not overwhelmingly optimistic, despite the fact that the double bottom pattern implies a reversal of a trend. Moreover, the vast majority (73%) of all SWFX positions are long, meaning here the risks are also skewed in favour of the bearish camp.

Tue, 17 May 2016 11:54:18 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.