Note: This section contains information in English only.

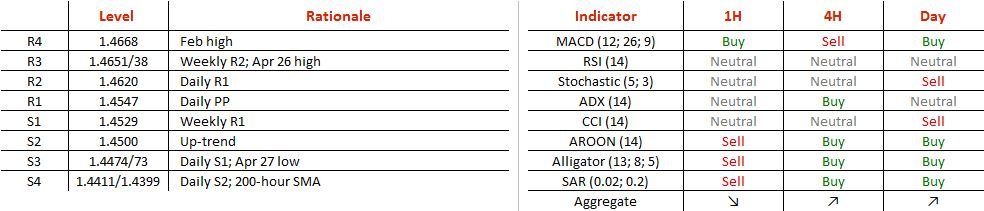

The near-term outlook is bullish. A case of a decent rebound implied by the fact that GBP/USD is testing the lower boundary of the ascending channel is hardened by the four-hour and daily technical indicators. The main near-term challenge is a cluster of resistances between 1.4670 and 1.4670, consisting of the weekly R2 and the April and March highs. There we should be ready for a bearish correction. In May however, the rally will be expected to be stopped by a major 22-month falling trend-line. Meanwhile, in case the price dips under the green trend-line, the first target will be the daily S1 and April 27 low at 1.4474/73, followed by the 200-hour SMA at 1.4411.

The near-term outlook is bullish. A case of a decent rebound implied by the fact that GBP/USD is testing the lower boundary of the ascending channel is hardened by the four-hour and daily technical indicators. The main near-term challenge is a cluster of resistances between 1.4670 and 1.4670, consisting of the weekly R2 and the April and March highs. There we should be ready for a bearish correction. In May however, the rally will be expected to be stopped by a major 22-month falling trend-line. Meanwhile, in case the price dips under the green trend-line, the first target will be the daily S1 and April 27 low at 1.4474/73, followed by the 200-hour SMA at 1.4411.

Thu, 28 Apr 2016 06:48:28 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.