Note: This section contains information in English only.

Fri, 15 Apr 2016 14:00:09 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

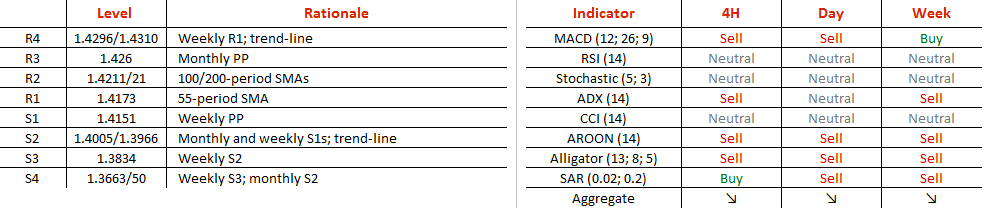

The Cable's trading range is gradually narrowing down. It has already led to an emergence of the falling wedge pattern. On the one hand, future risks can be skewed to the upside, which is implied by the pattern's nature. On the other hand, very few signals are indicating there is going to be a rally of the Pound. At first, aggregate technical indicators on all time frames are recommending to sell the pair. More than two thirds of all SWFX positions are long, which means the market remains quite overcrowded with the bulls. The base scenario assumes GBP/USD will be driven mostly by the cluster of simple moving averages at 1.4173/1.4221. A renewal of growth will be possible at 1.40 (monthly/weekly S1, trend-line).

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.