Note: This section contains information in English only.

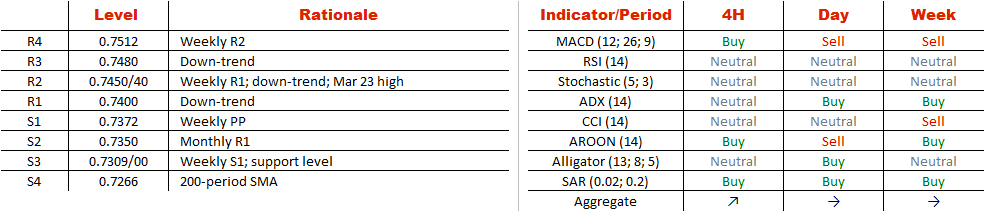

The risks for AUD/CHF are heavily skewed to the downside at the moment. For one, the currency pair has recently formed a descending triangle, a pattern that indicates growing supply. In addition, the exchange rate is fluctuating right at the intersection of two major trend-lines: one joins the peaks of the last 13 months and the other is more than three and a half years old. Accordingly, we would expect the Aussie to decline. The immediate support is at 0.7350, represented by the monthly R1, followed by the lower bound of the pattern circa 0.73 francs. At the same time, the Australian Dollar is moderately overbought in the SWFX market—56% of open positions are long, which only adds to the bearish bias towards the pair.

The risks for AUD/CHF are heavily skewed to the downside at the moment. For one, the currency pair has recently formed a descending triangle, a pattern that indicates growing supply. In addition, the exchange rate is fluctuating right at the intersection of two major trend-lines: one joins the peaks of the last 13 months and the other is more than three and a half years old. Accordingly, we would expect the Aussie to decline. The immediate support is at 0.7350, represented by the monthly R1, followed by the lower bound of the pattern circa 0.73 francs. At the same time, the Australian Dollar is moderately overbought in the SWFX market—56% of open positions are long, which only adds to the bearish bias towards the pair.

Wed, 30 Mar 2016 07:11:06 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.