Note: This section contains information in English only.

Mon, 07 Mar 2016 14:56:04 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

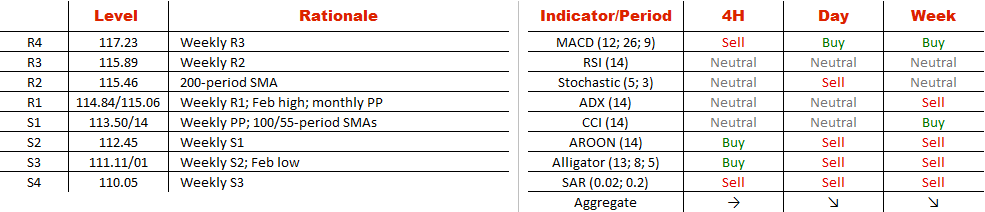

Rectangles are typical continuation patterns, meaning there exists a high probability of a failure of the US Dollar against the Japanese Yen. Therefore, the pattern seems to only offer a transitory stabilization of the pair before another leg down and the Yen's appreciation. The key zone to watch now is located in between the 113.50 and 113.16 levels, where two moving averages on different time-frames are coinciding with the weekly pivot point. By dropping below here, USD/JPY will pave the way for a loss to 111 in the near-term where the weekly S2 guards February lows. On top of that, daily and weekly indicators are USD-short, and the American currency is also overbought in the SWFX market (71% bullish).

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.