Note: This section contains information in English only.

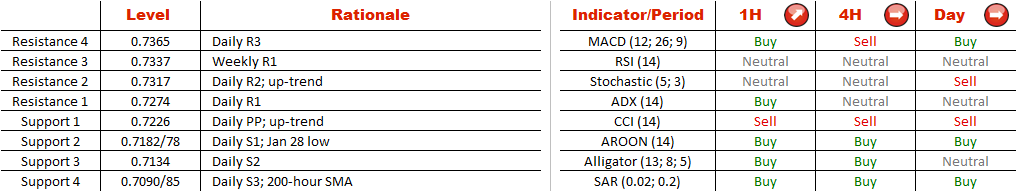

There are signs that the latest recovery from 0.68 might have come to an end. CAD/CHF is trading within the boundaries of the rising wedge, and this implies weakening demand for the Loonie. The base case scenario is a dip through the green trend-line during the next two days. If this is indeed the case, the first target will be at 0.7180 (Jan 28 low), but the pair will have the potential to decline lower, down to the 0.7085/70 demand zone, where we have the 200-hour SMA, weekly pivot point, and Jan 26 low. At the same time, if the Dollar manages to gain a solid foothold above 0.7260 (Jan 5 high), the chances are that the current recovery will be able to extend even up to 0.7750, namely Dec high.

There are signs that the latest recovery from 0.68 might have come to an end. CAD/CHF is trading within the boundaries of the rising wedge, and this implies weakening demand for the Loonie. The base case scenario is a dip through the green trend-line during the next two days. If this is indeed the case, the first target will be at 0.7180 (Jan 28 low), but the pair will have the potential to decline lower, down to the 0.7085/70 demand zone, where we have the 200-hour SMA, weekly pivot point, and Jan 26 low. At the same time, if the Dollar manages to gain a solid foothold above 0.7260 (Jan 5 high), the chances are that the current recovery will be able to extend even up to 0.7750, namely Dec high.

Fri, 29 Jan 2016 06:39:06 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.