Note: This section contains information in English only.

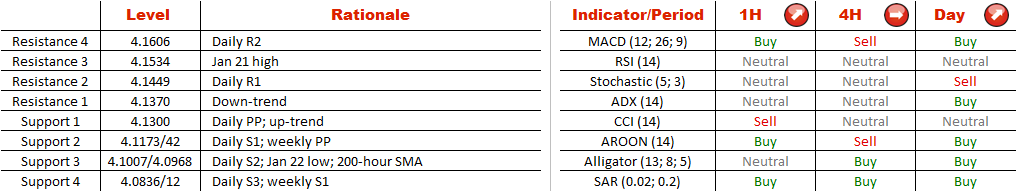

For some reason there is a striking similarity between the current situations in AUD/NZD and USD/PLN. Both have triangles forming within the ascending channels. However, the case for a rally here is somewhat stronger, considering that the US Dollar is in fact oversold—68% of positions are short. Accordingly, our base case scenario is a rally through the near-term trend-line at 4.1370 and the January 21 high up to the upper edge of the channel between 4.19 and 4.20. Meanwhile, there are plenty of potential floors in case USD/PLN dips through 4.13. The first one will be the weekly PP at 4.1170, followed by a combination of the daily S2, January 22 low and the 200-hour SMA around 4.10.

For some reason there is a striking similarity between the current situations in AUD/NZD and USD/PLN. Both have triangles forming within the ascending channels. However, the case for a rally here is somewhat stronger, considering that the US Dollar is in fact oversold—68% of positions are short. Accordingly, our base case scenario is a rally through the near-term trend-line at 4.1370 and the January 21 high up to the upper edge of the channel between 4.19 and 4.20. Meanwhile, there are plenty of potential floors in case USD/PLN dips through 4.13. The first one will be the weekly PP at 4.1170, followed by a combination of the daily S2, January 22 low and the 200-hour SMA around 4.10.

Tue, 26 Jan 2016 07:33:04 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.