Note: This section contains information in English only.

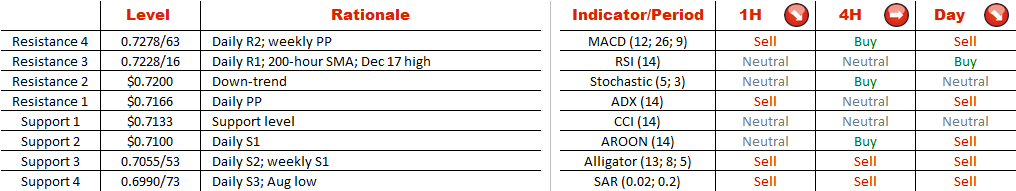

Support at 0.7130 should soon no longer be able to underpin the rate. Taking into account that CAD/CHF is trading within a descending triangle and the technical indicators are mostly giving ‘sell' signals, our bias is negative. Moreover, a significant majority of the SWFX market participants, namely 73%, are bulls, implying that the Loonie is overbought. Beneath 0.7130 the pair is expected to aim for the weekly S1 at 0.7055, though the main challenge for the downward momentum is seen at 0.6970, represented by the August low. Meanwhile, in addition to the trend-line at 0.72 the 200-hour SMA and Dec 17 at 0.7230 are creating a strong ceiling for the near-term rallies.

Support at 0.7130 should soon no longer be able to underpin the rate. Taking into account that CAD/CHF is trading within a descending triangle and the technical indicators are mostly giving ‘sell' signals, our bias is negative. Moreover, a significant majority of the SWFX market participants, namely 73%, are bulls, implying that the Loonie is overbought. Beneath 0.7130 the pair is expected to aim for the weekly S1 at 0.7055, though the main challenge for the downward momentum is seen at 0.6970, represented by the August low. Meanwhile, in addition to the trend-line at 0.72 the 200-hour SMA and Dec 17 at 0.7230 are creating a strong ceiling for the near-term rallies.

Fri, 18 Dec 2015 08:01:18 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.