Note: This section contains information in English only.

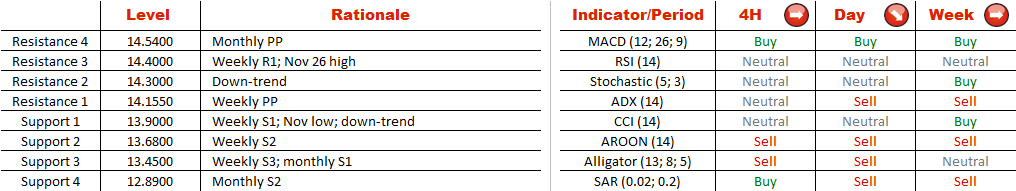

As things stand now, silver is likely to keep losing value. Any near-term rallies are to be limited by the upper boundary of the emerging channel at 14.30, while the key support is at 13.90, represented by the falling support trend-line, Nov low and weekly S1. If this demand level is broken, the next target should be 13.45, namely the weekly S3 and monthly S1. In the meantime, in case the bulls overpower bears at 14.30, we may well see a test of the 200-period SMA at 14.80, though the rate will have to pass through the Nov 26 high and monthly PP first. Another reason to be bearish is a high percentage of long positions—they take up three fourths of the SWFX market.

As things stand now, silver is likely to keep losing value. Any near-term rallies are to be limited by the upper boundary of the emerging channel at 14.30, while the key support is at 13.90, represented by the falling support trend-line, Nov low and weekly S1. If this demand level is broken, the next target should be 13.45, namely the weekly S3 and monthly S1. In the meantime, in case the bulls overpower bears at 14.30, we may well see a test of the 200-period SMA at 14.80, though the rate will have to pass through the Nov 26 high and monthly PP first. Another reason to be bearish is a high percentage of long positions—they take up three fourths of the SWFX market.

Fri, 04 Dec 2015 07:52:31 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.