Note: This section contains information in English only.

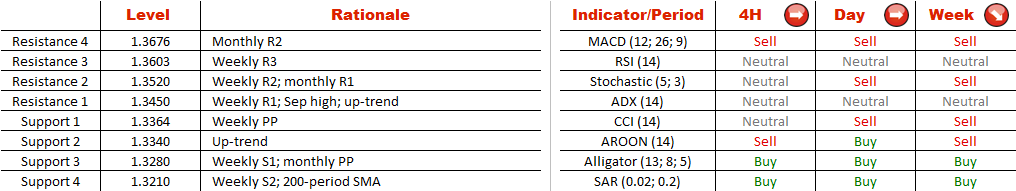

The risks are heavily skewed to the downside for USD/CAD. First, the price is approaching a tough resistance level represented by the September high. Secondly, the pair is forming a rising wedge, a pattern that is often followed by a sell-off. The point against such a scenario is the SWFX sentiment, being that the bears already take up 60% of the market, and it will be difficult for them to increase this percentage. Still, the base scenario is a dip through the up-trend at 1.3340. The initial target will then be the weekly S1 and monthly PP at 1.3290/80, while an additional strong demand area is near 1.3210, created by the weekly S2 and long-term moving average.

The risks are heavily skewed to the downside for USD/CAD. First, the price is approaching a tough resistance level represented by the September high. Secondly, the pair is forming a rising wedge, a pattern that is often followed by a sell-off. The point against such a scenario is the SWFX sentiment, being that the bears already take up 60% of the market, and it will be difficult for them to increase this percentage. Still, the base scenario is a dip through the up-trend at 1.3340. The initial target will then be the weekly S1 and monthly PP at 1.3290/80, while an additional strong demand area is near 1.3210, created by the weekly S2 and long-term moving average.

Wed, 02 Dec 2015 07:25:16 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.