Note: This section contains information in English only.

Mon, 09 Nov 2015 14:28:07 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

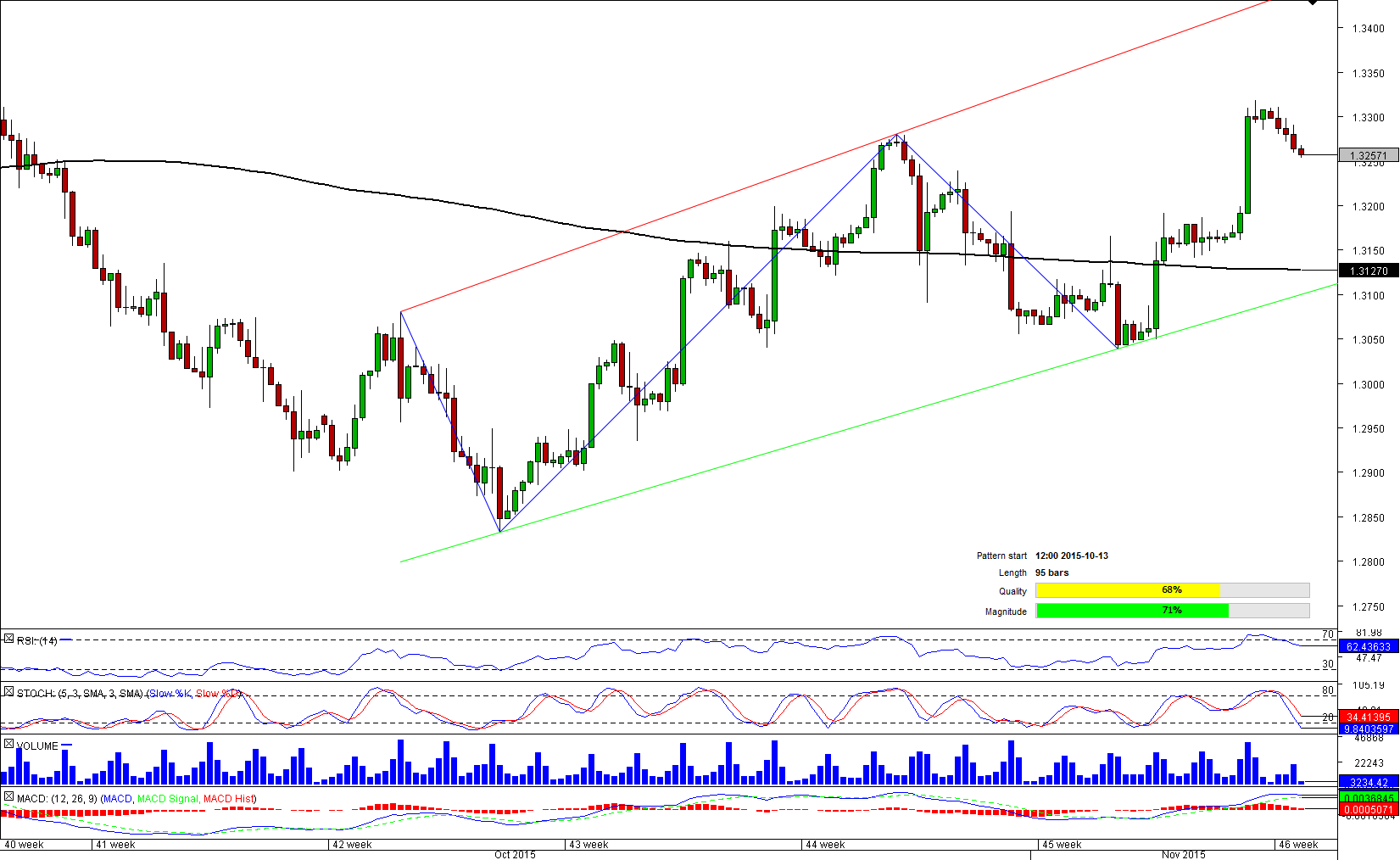

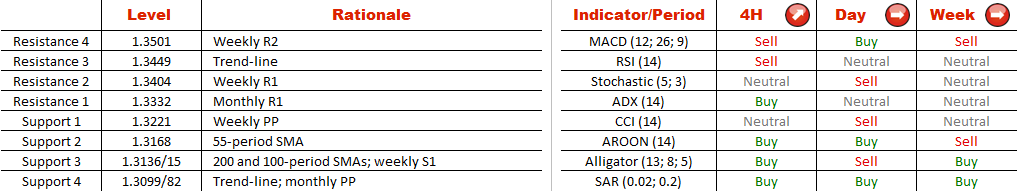

After a sharp growth at the end of the last week, the Buck has been cooling down on Monday after meeting the October 27 high. Despite bullish signals from four-hour studies, we expect USD/CAD to face some difficulties in the next 24 hours. At first, the monthly R1 at 1.3332 should be penetrated. This event can boost sentiment among bulls who will send the pair up to 1.3450 this week. Failure at the mentioned monthly resistance should trigger losses down to 200-period SMA at 1.3136, where the cross will approach other crucial supports including the pattern's lower trend-line. Nonetheless, SWFX market sentiment is completely neutral, meaning neither bullish nor bearish scenario is supported by traders.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.