Note: This section contains information in English only.

Tue, 20 Oct 2015 12:43:52 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

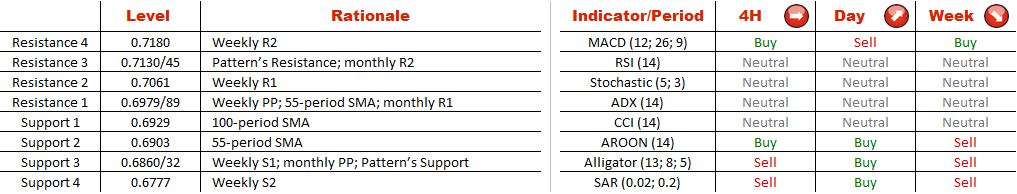

The Aussie has been in a decline versus the Swiss Franc since the previous working week, when the sell-off began around the 0.71 level. Now AUD/CHF seems to be supported by the 200-period moving average, currently at 0.6903, which is reinforced by the 100-period SMA from above. A drop below both of them should resume the downward tendency of this currency pair, but the pattern's lower edge is still expected to act as a reliable demand in the future. A recovery may begin around 0.6840, which is a location of the monthly pivot point and weekly S1 at the moment. On top of that, 72% of all SWFX traders are long on the Aussie, while daily indicators are pointing upwards.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.