Note: This section contains information in English only.

Thu, 08 Oct 2015 12:24:11 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

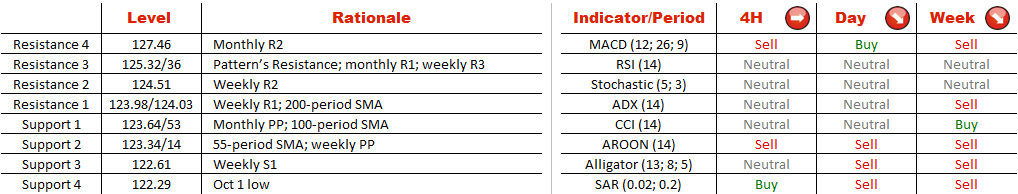

Despite attempts to recover, CHF/JPY remains capped by the 200-period SMA from the north. Technical indicators on daily and weekly time frames suggest the Swiss currency will fail at this important resistance line. Moreover, the similar view is shared by the majority (66%) of market participants at the moment. Nonetheless, bulls may rely on some support from the monthly pivot point and 100/55-period SMAs at 123.64/34. In case the 200-period SMA is eventually violated, we can observe the value of the pair surging as high as the pattern's upper boundary at 125.32, which will be even more difficult to breach due to additional supply created by monthly R1 and weekly R3.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.