Note: This section contains information in English only.

Tue, 22 Sep 2015 13:25:05 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

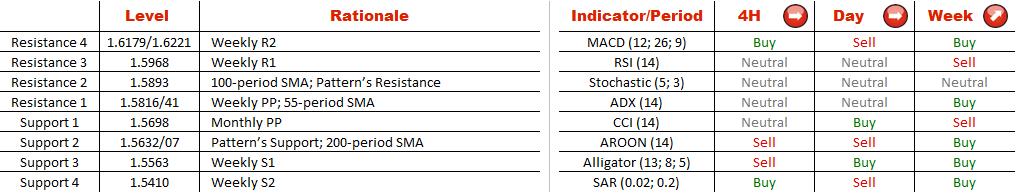

The apex of the present pattern can be reached by the end of next week; however, we suggest the break-out can happen sooner than anticipated. According to weekly technical indicators, the outlook is quite positive. On the contrary, 4H and daily studies are cautious in their projections, while SWFX sentiment is broadly neutral toward EUR/AUD. From the north the pair is capped by the weekly pivot point and 55/100-period moving averages at 1.5816/93. At the same time, bulls may rely on support from the monthly pivot point and 200-period SMA at 1.5632/07. These conditions complicate the near term forecast, making a "hold" stance more appropriate to choose and wait for additional market signals.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.