Note: This section contains information in English only.

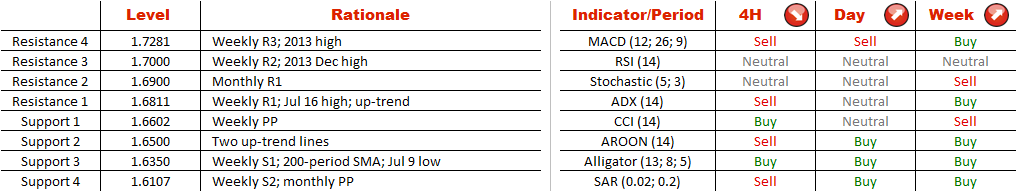

Despite EUR/NZD standing right at the multi-month up-trend (thick black line), it might be risky to go long just yet. The reason is the rising wedge, a pattern that suggests a reversal. The price opened sharply lower this week, and the bears could attempt to push the rate lower. A breach of 1.65 will be a strong sell signal, and the nearby supports, such as 1.65 (Jul 9 low and 200-period SMA) and 1.6043 (Jun 29 low) might not be able to stop the decline. Nevertheless, the technical indicators are mostly pointing upwards, and it might be a reasonable idea to wait for a confirmation of a recovery, which is supposed to be the Euro gaining a foothold above 1.68 (Jul 16 high).

Despite EUR/NZD standing right at the multi-month up-trend (thick black line), it might be risky to go long just yet. The reason is the rising wedge, a pattern that suggests a reversal. The price opened sharply lower this week, and the bears could attempt to push the rate lower. A breach of 1.65 will be a strong sell signal, and the nearby supports, such as 1.65 (Jul 9 low and 200-period SMA) and 1.6043 (Jun 29 low) might not be able to stop the decline. Nevertheless, the technical indicators are mostly pointing upwards, and it might be a reasonable idea to wait for a confirmation of a recovery, which is supposed to be the Euro gaining a foothold above 1.68 (Jul 16 high).

Mon, 20 Jul 2015 06:13:21 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.