Note: This section contains information in English only.

Mon, 13 Jul 2015 14:12:05 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

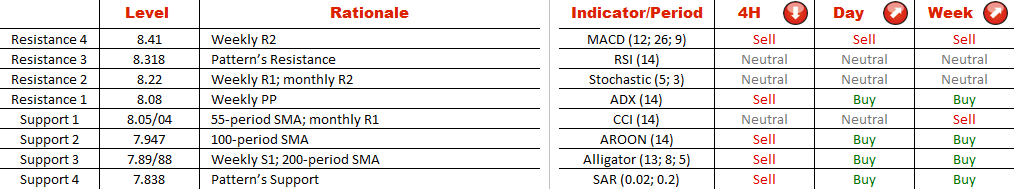

The US Dollar was forced to return above the 55-period SMA and monthly R1 on Monday, after testing these levels last week. Therefore, the bearish correction is under a threat of being terminated in the nearest future, especially considering the strength of the next demand areas around 7.95, 7.88 and 7.83. As a result of that, daily and weekly technical indicators are currently giving confident positive signals, suggesting that the Greenback is a "buy" against the Norwegian Krone at the moment. On the other hand, the short-term downward risk remains in place, as 4H studies and the majority of SWFX traders (74%) are strongly bearish towards this currency pair.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.