Note: This section contains information in English only.

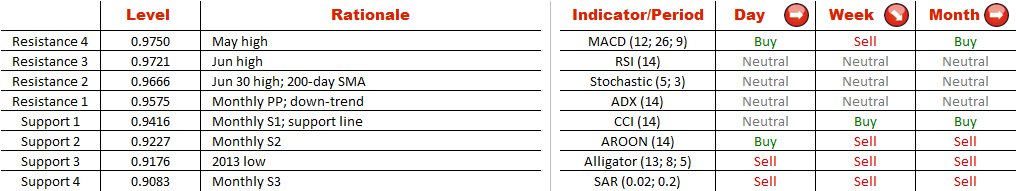

Despite the fact that AUD/CAD is currently trading between the major demand and supply zones, there should soon be a break-out, as we are closing in on the apex of the triangle. Considering the nature of the pattern, the bears are more likely to overpower the bulls, and this will expose the 2013 low at 0.9176. In the meantime, if AUD/CAD gains a foothold above 0.9575, further recovery will be difficult, being that apart from a combination of the Jun 30 high and 200-day SMA at 0.9666, there are also some other important levels nearby (May and June peaks). Concerning the sentiment, the market remains undecided, as the numbers of longs (48%) and shorts (52%) are nearly equal.

Despite the fact that AUD/CAD is currently trading between the major demand and supply zones, there should soon be a break-out, as we are closing in on the apex of the triangle. Considering the nature of the pattern, the bears are more likely to overpower the bulls, and this will expose the 2013 low at 0.9176. In the meantime, if AUD/CAD gains a foothold above 0.9575, further recovery will be difficult, being that apart from a combination of the Jun 30 high and 200-day SMA at 0.9666, there are also some other important levels nearby (May and June peaks). Concerning the sentiment, the market remains undecided, as the numbers of longs (48%) and shorts (52%) are nearly equal.

Mon, 13 Jul 2015 07:07:03 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.