Note: This section contains information in English only.

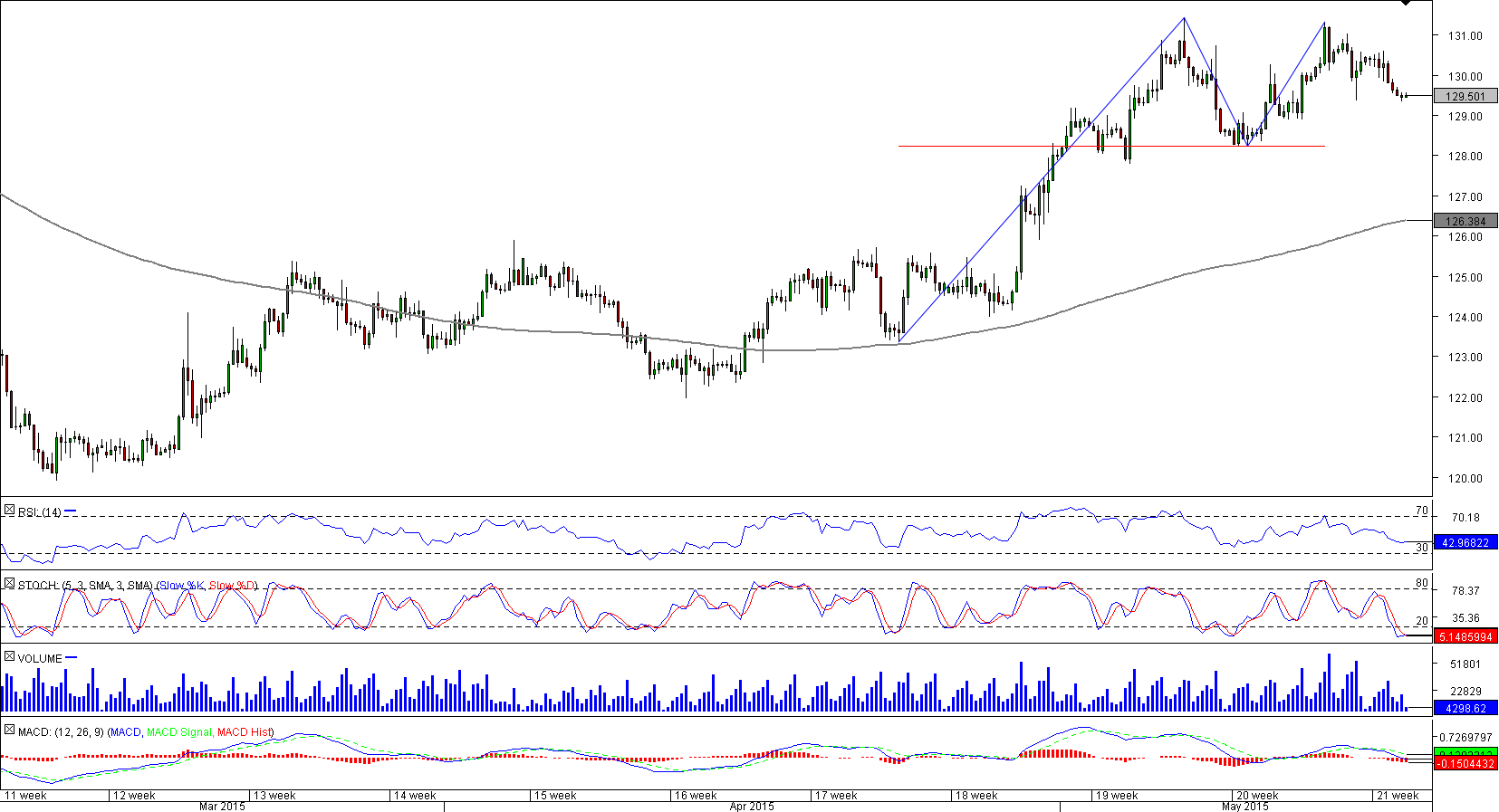

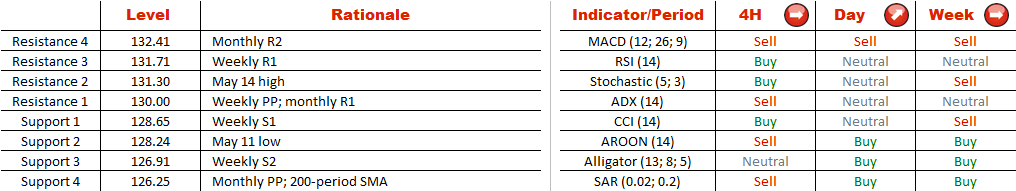

Although because of almost perfectly horizontal price chart of USD/JPY correlation between CHF/JPY and USD/CHF should be close to negative 1, the first Franc-cross seems to have a higher chance of forming a reversal pattern than USD/CHF. Here the potential decline beneath the neck-line (May 11 low at 128.24) will have around 200 pips of free space before it encounters a significant demand area. The sell-off will probably end around 126.25, where the monthly PP merges with the 200-period SMA, without making it all the way to the start of the Apr 29-May 7 rally, namely to 124 yen. Meanwhile, the sentiment is moderately bearish, with three fifths of the traders holding short positions.

Although because of almost perfectly horizontal price chart of USD/JPY correlation between CHF/JPY and USD/CHF should be close to negative 1, the first Franc-cross seems to have a higher chance of forming a reversal pattern than USD/CHF. Here the potential decline beneath the neck-line (May 11 low at 128.24) will have around 200 pips of free space before it encounters a significant demand area. The sell-off will probably end around 126.25, where the monthly PP merges with the 200-period SMA, without making it all the way to the start of the Apr 29-May 7 rally, namely to 124 yen. Meanwhile, the sentiment is moderately bearish, with three fifths of the traders holding short positions.

Tue, 19 May 2015 07:45:05 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.