Note: This section contains information in English only.

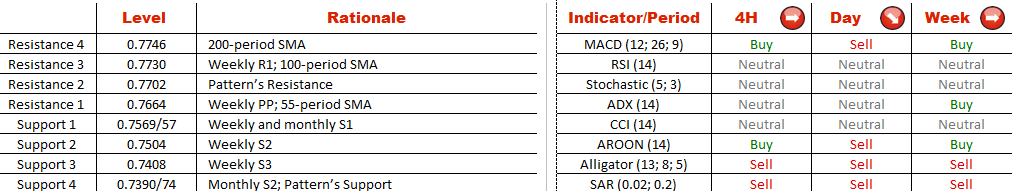

A recent recovery of the Canadian Dollar was immediately stopped by the monthly pivot point and 200-period SMA at 0.7750. Bears gained strength at these levels and the pair started to decline. At the moment CAD/CHF is nearing the weekly and monthly S1 demand zones at 0.7570. In case the Loonie is forced to decline beyond them, the next long-term target will become the monthly S2 at 0.7390, with the intermediate goal at 0.75 (weekly S2). On a daily basis, technical indicators are giving signals to sell this currency pair, even though the weekly ones are mixed. In the meantime, SWFX market participants support the opposite positive case for the cross in 65% of all cases.

A recent recovery of the Canadian Dollar was immediately stopped by the monthly pivot point and 200-period SMA at 0.7750. Bears gained strength at these levels and the pair started to decline. At the moment CAD/CHF is nearing the weekly and monthly S1 demand zones at 0.7570. In case the Loonie is forced to decline beyond them, the next long-term target will become the monthly S2 at 0.7390, with the intermediate goal at 0.75 (weekly S2). On a daily basis, technical indicators are giving signals to sell this currency pair, even though the weekly ones are mixed. In the meantime, SWFX market participants support the opposite positive case for the cross in 65% of all cases.

Mon, 18 May 2015 14:18:04 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.