Note: This section contains information in English only.

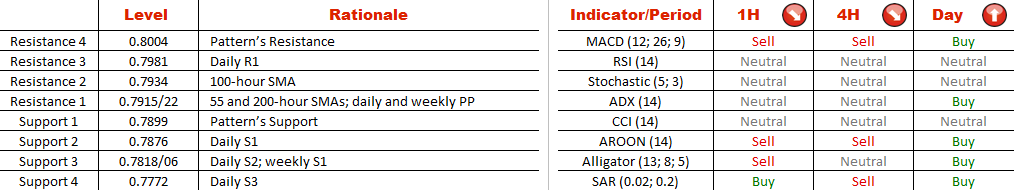

Despite continuously testing the lower boundary of the triangle pattern on Monday, the AUD/USD currency pair is likely to rebound in the near-term, while additional stimulus should be provided by the daily S1 at 0.7876. The bullish case is supported by 71% of SWFX market participants and daily technical indicators. However, there are downside risks at present as well. Both weekly PP and 200-hour SMA will attempt to withhold bullish pressure, while in case of failure to penetrate these levels the Australian Dollar may slump considerably. A consolidation below daily S1 will pave the way towards weekly S1 at 0.78, while this case is bolstered by 1H and 4H technical studies at the moment.

Despite continuously testing the lower boundary of the triangle pattern on Monday, the AUD/USD currency pair is likely to rebound in the near-term, while additional stimulus should be provided by the daily S1 at 0.7876. The bullish case is supported by 71% of SWFX market participants and daily technical indicators. However, there are downside risks at present as well. Both weekly PP and 200-hour SMA will attempt to withhold bullish pressure, while in case of failure to penetrate these levels the Australian Dollar may slump considerably. A consolidation below daily S1 will pave the way towards weekly S1 at 0.78, while this case is bolstered by 1H and 4H technical studies at the moment.

Mon, 11 May 2015 13:23:04 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.