Note: This section contains information in English only.

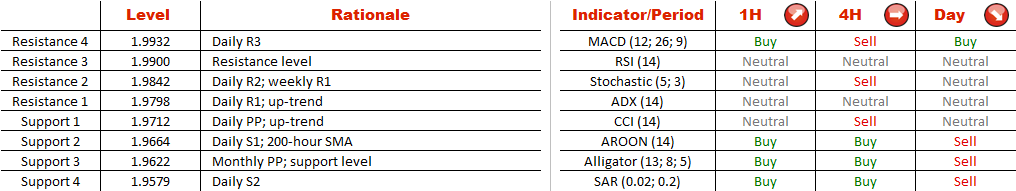

The Sterling has been recovering since last Wednesday, but there are indications the bullish momentum is about to give way for a sell-off. GBP/NZD has formed a rising wedge, a reversal pattern, as a correction in a bearish market. Accordingly, we expect the lower trend-line (currently at 1.9712) to be violated eventually. In this case the first target will be the 200-hour SMA at 1.9664, followed by other strong supports at 1.9622 and at 1.9520. On the other hand, should the price close above the resistance trend-line (1.98), the objectives will be 1.9842 and then 1.9900. Violation of the latter level may well result in a rally up to 2.0250. Still, most positions are short, namely 69% of them.

The Sterling has been recovering since last Wednesday, but there are indications the bullish momentum is about to give way for a sell-off. GBP/NZD has formed a rising wedge, a reversal pattern, as a correction in a bearish market. Accordingly, we expect the lower trend-line (currently at 1.9712) to be violated eventually. In this case the first target will be the 200-hour SMA at 1.9664, followed by other strong supports at 1.9622 and at 1.9520. On the other hand, should the price close above the resistance trend-line (1.98), the objectives will be 1.9842 and then 1.9900. Violation of the latter level may well result in a rally up to 2.0250. Still, most positions are short, namely 69% of them.

Tue, 31 Mar 2015 05:40:54 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.