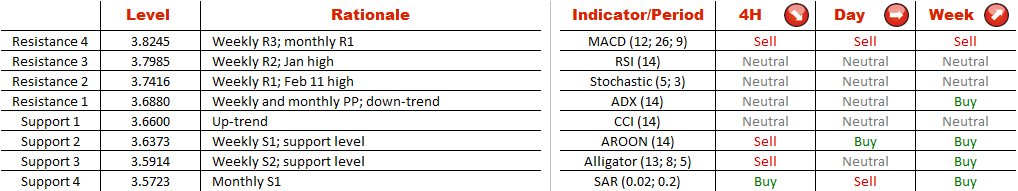

Considering that the pattern implies continuation of the major trend and the market is distinctly bullish, the currency pair is expected to breach resistance at 3.69 despite its formidability (weekly and monthly PP, 200-period SMA, and four-week down-trend) and re-challenge the Jan high at 3.80. However, if the support trend-line at 3.66 gives in first, the US Dollar will be exposed to a dip down to 3.5920, though there is a support line at 3.6340 also worth mentioning.

Note: This section contains information in English only.

Starting from late January we observed a consolidation as a result of a sharp up-move that was initiated in mid-December. This has eventually led to formation of a symmetrical triangle

Starting from late January we observed a consolidation as a result of a sharp up-move that was initiated in mid-December. This has eventually led to formation of a symmetrical triangle

Considering that the pattern implies continuation of the major trend and the market is distinctly bullish, the currency pair is expected to breach resistance at 3.69 despite its formidability (weekly and monthly PP, 200-period SMA, and four-week down-trend) and re-challenge the Jan high at 3.80. However, if the support trend-line at 3.66 gives in first, the US Dollar will be exposed to a dip down to 3.5920, though there is a support line at 3.6340 also worth mentioning.

Fri, 20 Feb 2015 08:12:13 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

Considering that the pattern implies continuation of the major trend and the market is distinctly bullish, the currency pair is expected to breach resistance at 3.69 despite its formidability (weekly and monthly PP, 200-period SMA, and four-week down-trend) and re-challenge the Jan high at 3.80. However, if the support trend-line at 3.66 gives in first, the US Dollar will be exposed to a dip down to 3.5920, though there is a support line at 3.6340 also worth mentioning.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.