Note: This section contains information in English only.

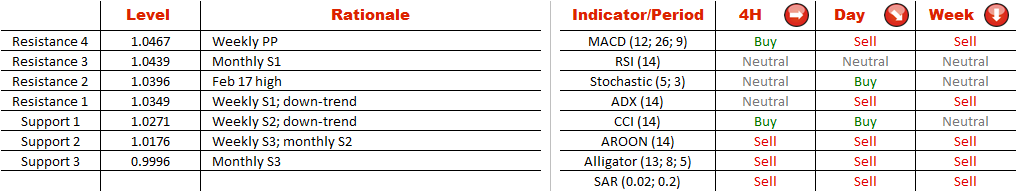

Considering the current conditions in the market, AUD/NZD appears to be in a good position to negate the losses incurred starting from late January. The selling pressure is weakening, as pointed out by contracting trading range and falling trading volumes. A breach of the resistance trend-line (currently at 1.0350) will confirm bullish intentions of the Aussie. The potential targets will then be the weekly R1 together with the long-term SMA at 1.0545, the monthly pivot point together with the Feb 6 high at 1.0614, and finally this year's high at 1.08. However, it must be mentioned that the technical indicators are against such a course of events, giving strong ‘sell' signals for the daily and weekly time-frames.

Considering the current conditions in the market, AUD/NZD appears to be in a good position to negate the losses incurred starting from late January. The selling pressure is weakening, as pointed out by contracting trading range and falling trading volumes. A breach of the resistance trend-line (currently at 1.0350) will confirm bullish intentions of the Aussie. The potential targets will then be the weekly R1 together with the long-term SMA at 1.0545, the monthly pivot point together with the Feb 6 high at 1.0614, and finally this year's high at 1.08. However, it must be mentioned that the technical indicators are against such a course of events, giving strong ‘sell' signals for the daily and weekly time-frames.

Thu, 19 Feb 2015 07:12:24 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.