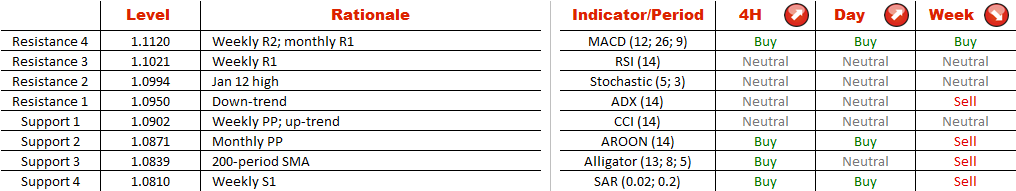

A base case scenario is a break-out to the upside through the down-trend at 1.0950 with a target at 1.1120, where the weekly R2 level coincides with the monthly R1. The rally in the near-term is also implied by the four-hour and daily technical indicators, but the longer-term studies say the Aussie is already overbought. At the same time, the sentiment is strongly bearish—74% of open positions are short.

Note: This section contains information in English only.

Although eventually AUD/SGD is likely to resume the sell-off started in September near 1.18, the currency pair has recently completed a triangle pattern that gives a reason to believe the current bullish correction is going to extend higher.

Although eventually AUD/SGD is likely to resume the sell-off started in September near 1.18, the currency pair has recently completed a triangle pattern that gives a reason to believe the current bullish correction is going to extend higher.

A base case scenario is a break-out to the upside through the down-trend at 1.0950 with a target at 1.1120, where the weekly R2 level coincides with the monthly R1. The rally in the near-term is also implied by the four-hour and daily technical indicators, but the longer-term studies say the Aussie is already overbought. At the same time, the sentiment is strongly bearish—74% of open positions are short.

Mon, 19 Jan 2015 07:05:38 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

A base case scenario is a break-out to the upside through the down-trend at 1.0950 with a target at 1.1120, where the weekly R2 level coincides with the monthly R1. The rally in the near-term is also implied by the four-hour and daily technical indicators, but the longer-term studies say the Aussie is already overbought. At the same time, the sentiment is strongly bearish—74% of open positions are short.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.