Note: This section contains information in English only.

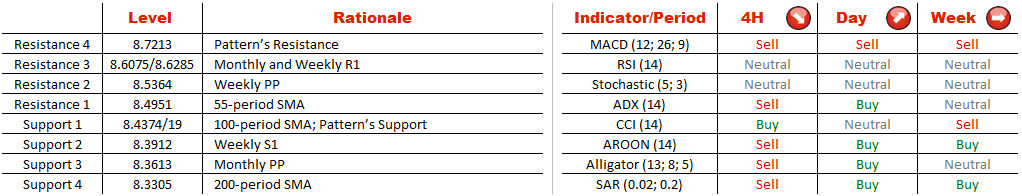

The Euro/Norwegian krona currency pair is now checking the strength of lower boundary of the bullish channel, which is going to determine the pair's future development. If the testing is successful, then we can expect the single currency to decline down to monthly pivot point at 8.3613 in the long-term. In case of failure, the pair will be set for a jump up to weekly pivot point at 8.5364. Technical indicators tend to believe in the first scenario, as five out of eight four-hour studies give bearish signals, while in the medium-term the cross may recover, as suggested by daily studies. Meanwhile, 70% of market participants hold short positions, waiting for the Euro to lose value.

The Euro/Norwegian krona currency pair is now checking the strength of lower boundary of the bullish channel, which is going to determine the pair's future development. If the testing is successful, then we can expect the single currency to decline down to monthly pivot point at 8.3613 in the long-term. In case of failure, the pair will be set for a jump up to weekly pivot point at 8.5364. Technical indicators tend to believe in the first scenario, as five out of eight four-hour studies give bearish signals, while in the medium-term the cross may recover, as suggested by daily studies. Meanwhile, 70% of market participants hold short positions, waiting for the Euro to lose value.

Mon, 10 Nov 2014 13:58:04 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.