Note: This section contains information in English only.

Tue, 05 Aug 2014 15:11:16 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

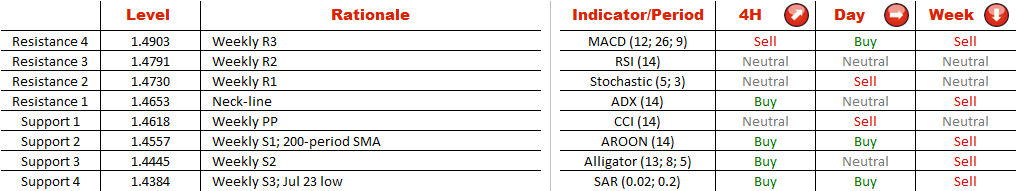

How EUR/CAD reacts to a test of 1.4563 is likely to define its behaviour in the next few days, potentially even weeks, since this level is the neck-line of a double bottom pattern. In case the resistance is broken to the upside, we can expect a bullish run through the weekly pivots and up to the Jun 6 high at 1.4957.

Conversely, should this line remain intact, the ensuing decline will most likely extend through the support at 1.4557 (weekly S1 and 200-period SMA) and down to 1.44, where the Jul 23 merges with the weekly S3. And while the four-hour studies are in favour of the former scenario, a majority of the weekly indicators is presently giving ‘sell' signals.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.