Note: This section contains information in English only.

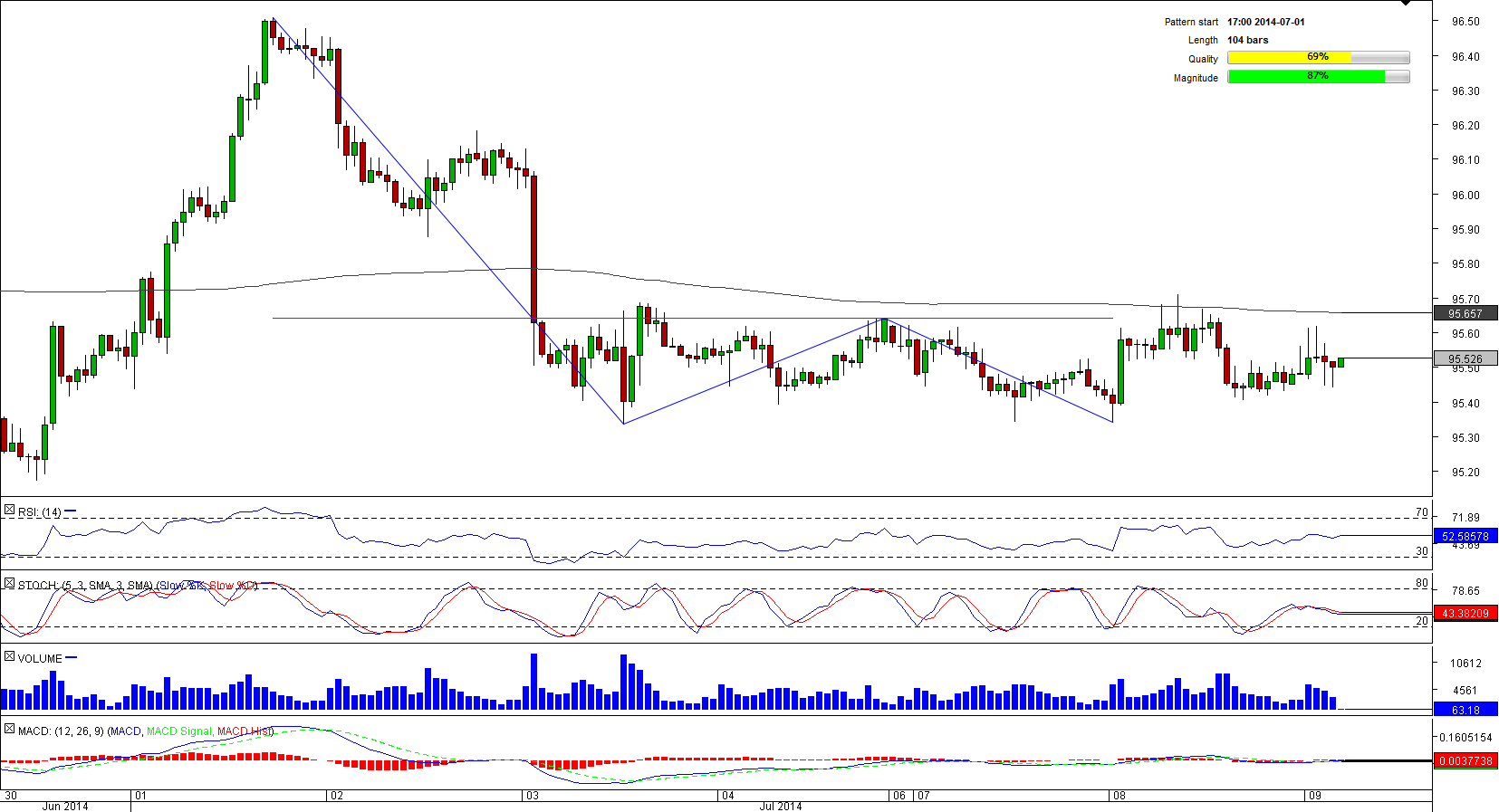

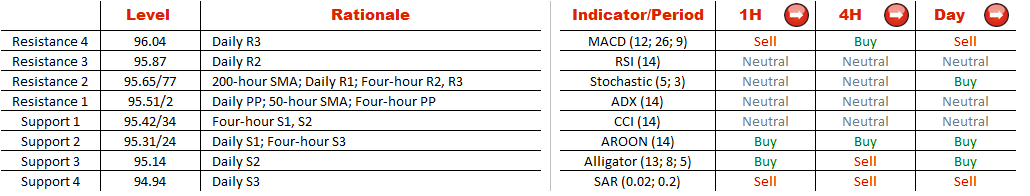

A double bottom pattern formed by AUD/JPY originated at a three-month high of 96.50 hit early July and has already lasted for 104 hours. Surprisingly, we did not see a breakout a day earlier after the pair managed to penetrate the neck-line at 95.64. The reason is that the pair failed to surpass the 200-hour SMA and was forced to come back to the area beneath the neck-line. However, the instrument is likely to receive a bullish impulse soon taking into account that 84% of traders on the SWFX bet on appreciation of the pair. Notwithstanding this, the pair's ability to exit the pattern remains questionable as the neck-line is still well-supported by the 200-hour SMA.

A double bottom pattern formed by AUD/JPY originated at a three-month high of 96.50 hit early July and has already lasted for 104 hours. Surprisingly, we did not see a breakout a day earlier after the pair managed to penetrate the neck-line at 95.64. The reason is that the pair failed to surpass the 200-hour SMA and was forced to come back to the area beneath the neck-line. However, the instrument is likely to receive a bullish impulse soon taking into account that 84% of traders on the SWFX bet on appreciation of the pair. Notwithstanding this, the pair's ability to exit the pattern remains questionable as the neck-line is still well-supported by the 200-hour SMA.

Wed, 09 Jul 2014 06:57:58 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.