At the moment, the currency couple is on the verge of a breakout as it has already approached the apex. Considering that more than 62% of market players hold long positions, the exit is likely to be bullish. Despite being neutral for the nearest term, technical data props up traders' opinion in the long-term.

Note: This section contains information in English only.

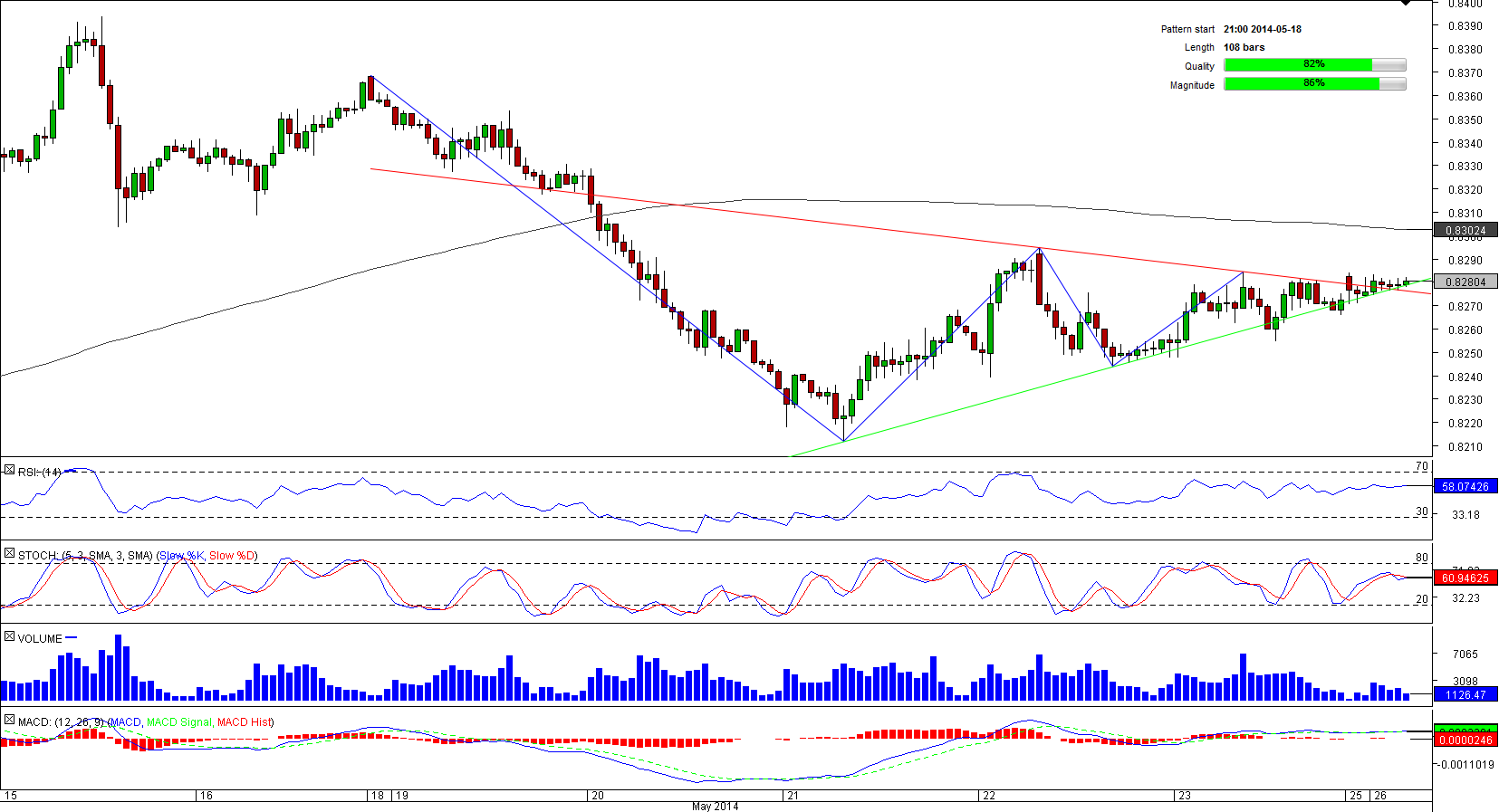

Since the beginning of May, we have observed an elevated volatility of AUD/CHF that added over 270 pips in 10 days ended when the instrument attained a one-year high of 0.8394. After that, the pair saw an accelerating decline that was a part of the triangle pattern it entered on May 18.

Since the beginning of May, we have observed an elevated volatility of AUD/CHF that added over 270 pips in 10 days ended when the instrument attained a one-year high of 0.8394. After that, the pair saw an accelerating decline that was a part of the triangle pattern it entered on May 18.

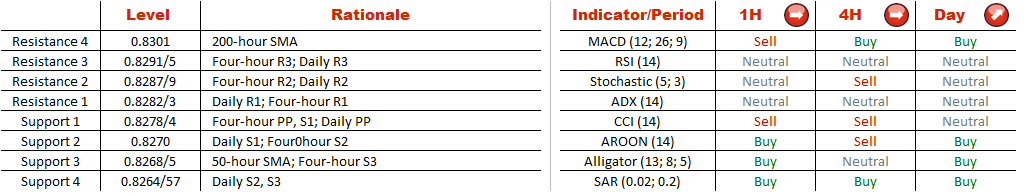

At the moment, the currency couple is on the verge of a breakout as it has already approached the apex. Considering that more than 62% of market players hold long positions, the exit is likely to be bullish. Despite being neutral for the nearest term, technical data props up traders' opinion in the long-term.

Mon, 26 May 2014 06:56:49 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

At the moment, the currency couple is on the verge of a breakout as it has already approached the apex. Considering that more than 62% of market players hold long positions, the exit is likely to be bullish. Despite being neutral for the nearest term, technical data props up traders' opinion in the long-term.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.