Note: This section contains information in English only.

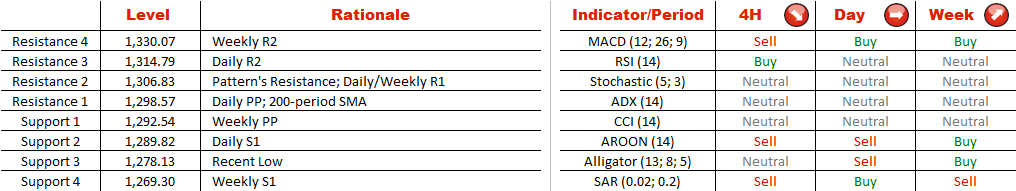

Gold has been depreciating versus the greenback since March, and the fact the falling wedge on the 4H chart is 222-bar long speaks in favour of the strong downtrend. The trading range is narrowing, however, it is too early to speak about the breakout. Currently, the pair is bounded by a weekly pivot at 1,292.54 from the downside and daily pivot and 200-period SMA at 1,298.57. Aggregate technical indicators are sending mixed signals, while market sentiment is strongly bullish, with 71% of opened positions being long. Keeping in mind stronger demand for the bullion amid Ukraine tensions, the pair is likely to penetrate the recent high soon and head towards the upper trend line.

Gold has been depreciating versus the greenback since March, and the fact the falling wedge on the 4H chart is 222-bar long speaks in favour of the strong downtrend. The trading range is narrowing, however, it is too early to speak about the breakout. Currently, the pair is bounded by a weekly pivot at 1,292.54 from the downside and daily pivot and 200-period SMA at 1,298.57. Aggregate technical indicators are sending mixed signals, while market sentiment is strongly bullish, with 71% of opened positions being long. Keeping in mind stronger demand for the bullion amid Ukraine tensions, the pair is likely to penetrate the recent high soon and head towards the upper trend line.

Fri, 16 May 2014 12:22:03 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.