Note: This section contains information in English only.

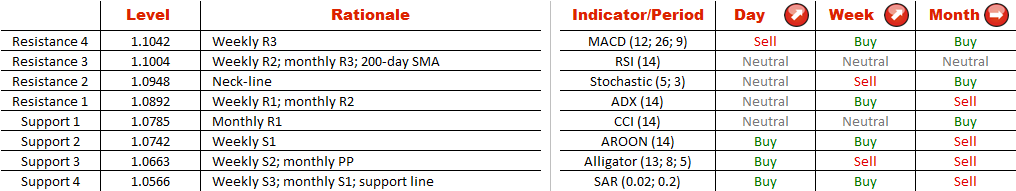

After a November-January sell-off AUD/NZD managed to stabilise near 1.0566, which has proven to be a reliable support level. As a result, there are now two prominent troughs standing next to each other, which implies a potential reversal of the bearish trend. Apparently, the SWFX market sees this scenario as very likely, being that 74% of open positions are long. Still, there is a necessary condition for the double bottom pattern to realise its full upward potential, namely a breach of the neck-line, which would pave the way to 1.1585. However, the supply area 1.1000/1.0950 is reinforced by the monthly R3 and 200-day SMA, thereby decreasing the chance of a break-out to the upside.

After a November-January sell-off AUD/NZD managed to stabilise near 1.0566, which has proven to be a reliable support level. As a result, there are now two prominent troughs standing next to each other, which implies a potential reversal of the bearish trend. Apparently, the SWFX market sees this scenario as very likely, being that 74% of open positions are long. Still, there is a necessary condition for the double bottom pattern to realise its full upward potential, namely a breach of the neck-line, which would pave the way to 1.1585. However, the supply area 1.1000/1.0950 is reinforced by the monthly R3 and 200-day SMA, thereby decreasing the chance of a break-out to the upside.

Mon, 28 Apr 2014 08:27:01 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.